了解并掌握PCB系统对马来西亚雇主来说至关重要,以确保遵守税法并准确管理工资。若少扣PCB,可能会面临巨额罚款;而若多扣PCB,可能会引起员工的不满。

这份全面的PCB指南将引导您掌握PCB的核心知识,包括如何计算扣税、按时提交以及遵守合规要求。

本文涵盖:

- 什么是 PCB?

- 哪些类型的收入需要缴纳 PCB?

- 雇主如何确定 PCB 扣除额?

- PCB是怎么计算的?

- 如何在 LHDN 注册为雇主?

- 我如何提交和支付 PCB?

- 当员工加入或离开我的公司时,如何通知 LHDN

- LHDN 规定雇主承担哪些责任?

- 不遵守规定的处罚是什么?

什么是 PCB?

PCB是马来文“Potongan Cukai Bulanan”的缩写,意为每月税款扣除(Monthly Tax Deductions, MTD)。它是根据您的就业收入,每月进行的扣税,用于支付您的年度税款。PCB由雇主从员工的月薪中扣除,并在每个月的工资发放时上缴至马来西亚内陆税收局(LHDN)。其目的是确保个人在全年内以分期方式支付税款,而不是在年末一次性支付,从而让员工的税款缴纳更加可控,同时最大化LHDN的税收收入。

哪些类型的收入需要缴纳 PCB?

雇主如何确定应扣缴的 PCB 金额?

雇主有三种选择:

- PCB 表格(Jadual PCB):适用于未使用薪资软件的雇主。该表格显示每个工资范围应扣缴的 PCB 金额,并考虑了员工申报的配偶和子女税收减免。该方法假设员工全年领取相同的工资,因此不如其他方法准确。虽然 PCB 表格自 2019 年起不再发布,但仍可通过 e-CP39 门户以电子方式使用。

- LHDN 计算器或 e-PCB 门户:LHDN 的计算器使用一个公式,根据员工年内之前月份的实际收入和减免数据,计算年应课税收入及剩余应纳税额,从而确定该月的 PCB 金额。e-PCB 门户也使用相同的公式进行计算。雇主可通过 e-PCB 门户计算并提交每月 PCB。

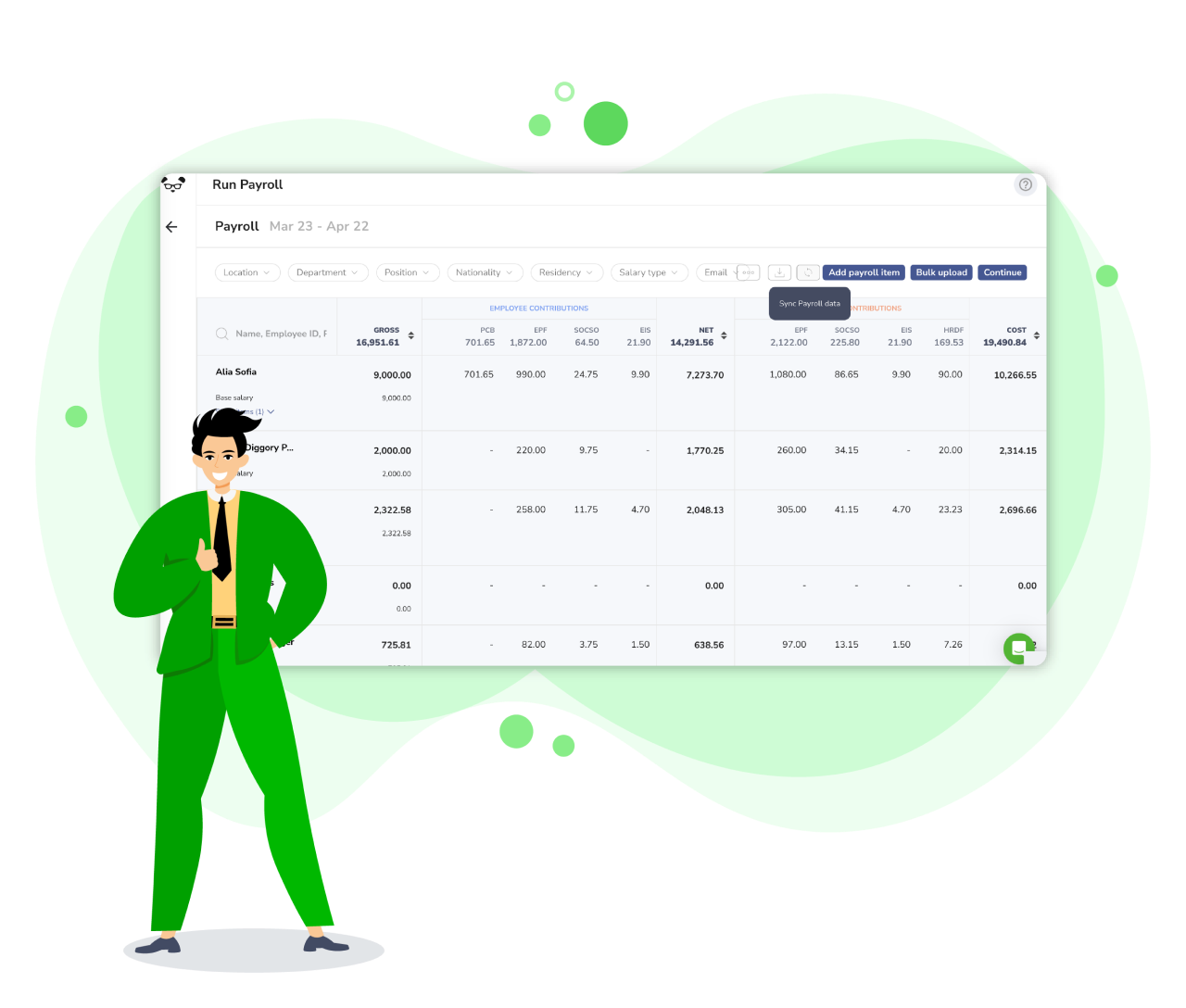

- 薪资软件:如 PayrollPanda 等薪资软件,使用与 LHDN 计算器相同的公式,根据每位员工输入的个人及薪酬数据自动计算 PCB。

PCB 如何计算?

虽然计算公式较为复杂,但可简化如下:

- 年应税收入 = 前几个月的应税收入 +(本月重复性应税收入 + 本月非重复性应税收入)+ 本月重复性应税收入 × 剩余月份数

- 年应税收入 – 税收减免 = 年应课税收入

- 然后根据年应课税收入适用税率计算年应纳税额

- PCB =(年应纳税额 – 已缴纳的 PCB)/ 剩余月份数

如何向 LHDN 注册成为雇主?

雇主需要向 LHDN 注册雇主税号(E 号码),以便缴纳 PCB 及提交年度雇主报税表(E 表格)。雇主可通过 MyTax 门户的 e-Daftar 在线完成注册流程。

通常在 5 个工作日内可获得 E 号码。

如何提交和缴纳 PCB?

雇主可通过以下任一 LHDN 门户提交 PCB:

- e-CP39:用于手动提交每月扣税及一次性申报,可使用 PCB 表格或 PCB 计算器。

- e-PCB:用于手动提交每月扣税,需输入数据,但系统会记录先前提交及累计收入和减免金额。

- e-Data PCB:通过上传文件提交,无需手动输入数据,雇主可上传由薪资软件如 PayrollPanda 生成的 PCB 文件。

付款方式包括:

1. 线上付款:通过上述门户使用 FPX 支付(支持以下银行):

- AmBank

- Bank Islam

- CIMB Bank

- Hong Leong Bank

- Maybank2e/Maybank2U

- Public Bank

- RHB Bank

2. 支票存款机:

- CIMB Bank 的支票存款机可接受付款。

3. POS Malaysia

- 可在 POS Malaysia 柜台以现金付款。

使用薪资软件的用户还可通过其银行门户上传 PCB 文件进行提交和付款,而无需登录 e-Data PCB 门户。

如何通知 LHDN 员工的入职或离职?

雇主需遵守以下关于员工变动的通知义务:

雇主在 LHDN 规定下的职责有哪些?

雇主需承担以下责任:

- 注册雇主 E 号码。

- 向新员工索取 TP3 表格,以获取其当前年度的前雇主累计收入与减免信息,用于 PCB 计算。

- 允许员工通过提交 TP1 表格 申报可选减免或税务回扣(如 Zakat)以减少 PCB。

- 每月从员工薪酬中扣除 PCB,并在下个月的第 15 日前缴纳至 LHDN。

- 在次年 3 月 31 日前(通过 MyTax 在线提交可至 4 月 30 日)提交 E 表格及 CP8D,汇报全年员工收入与减免信息。

- 在次年 2 月最后一天前向员工提供 EA 表格,以便其报税。

- 提交 CP22、CP22A 和 CP21 等相关通知表格。

- 若税务清算尚未完成,应暂缓支付员工款项达 90 天。

- 保留记录至少 7 年

不合规的处罚有哪些?

- 未申报纳税义务或未提交报税表(第 112(1) 条):罚款 RM200 至 RM20,000,或最长 6 个月监禁,或两者兼施。

- 错误申报(第 113(1)(b) 条):罚款 RM1,000 至 RM10,000,并加罚所少缴税额的两倍。

- 蓄意逃税(第 114(1) 条):如隐瞒收入、提供虚假信息或欺诈行为,罚款 RM1,000 至 RM20,000,或最多 3 年监禁,或两者兼施。另可加罚少缴税额的三倍。

温馨提示

本文内容仅供参考。我们已尽力确保内容的准确性,但不能保证完全无误。建议用户在处理关键事务前自行核实相关信息,不应完全依赖本文内容。