Audit-ready Payroll Software Poster

What is the LHDN?

The LHDN (Inland Revenue Board) is responsible for taxation in Malaysia. With audits, the Board reviews a company’s financial statements, records and tax returns to:

- Verify the company’s tax filings

- To detect underreporting or overreporting of taxes

- To flag tax evasion

Consequences of non-compliance in an LHDN audit can be severe, which can harm a company’s credibility and reputation. A company may face fines or penalties for misreporting their taxes. In case of tax evasion or fraud, the LHDN can take legal action.

To avoid penalties, it is important for companies to maintain accurate financial records and ensure accurate tax filings. These processes can be automated with audit-ready payroll software.

Read our guide on how to legally avoid taxes in Malaysia.

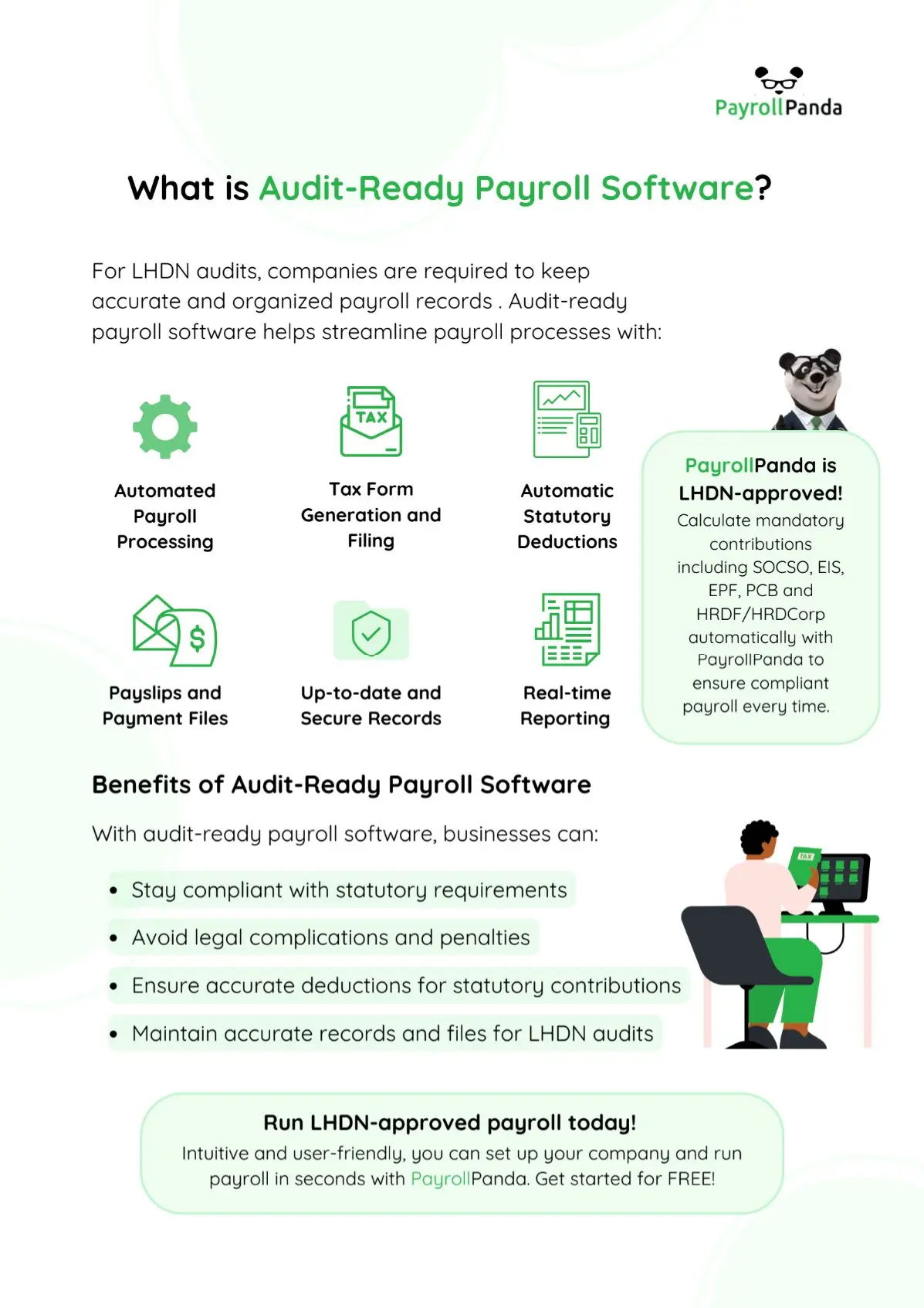

What is Audit-Ready Payroll Software?

Audit-ready payroll software is payroll software designed to help companies stay compliant and prepared for audits by authorities such as LHDN, EPF (KWSP), SOCSO (PERKESO), and EIS in Malaysia.

Audit-ready payroll software is ideal for SMEs, start-ups, and HR or payroll teams in Malaysia, especially those preparing for or undergoing LHDN audits.

It helps businesses stay compliant with local regulations, reduce audit risks and penalties, respond quickly to audit requests, and maintain credibility with authorities.

What Makes a Software Audit-Ready?

Audit-ready payroll software typically includes:

- Accurate tax and statutory calculations: Automatically calculates PCB/MTD, EPF, SOCSO, and EIS based on current Malaysian regulations.

- Complete payroll records and audit trails: Stores payslips, payroll reports, contribution schedules, and change logs that auditors may request.

- Error reduction and consistency: Minimises manual payroll errors that could lead to underpayment, overpayment, or misreporting.

- Easy reporting and document retrieval: Generates audit-friendly reports for LHDN audits, including payroll summaries and tax filings.

- Compliance updates: Keeps payroll calculations aligned with changes in Malaysian tax laws and statutory rates.

Learn more by downloading the following poster!

Payroll Panda’s free audit-ready payroll software poster