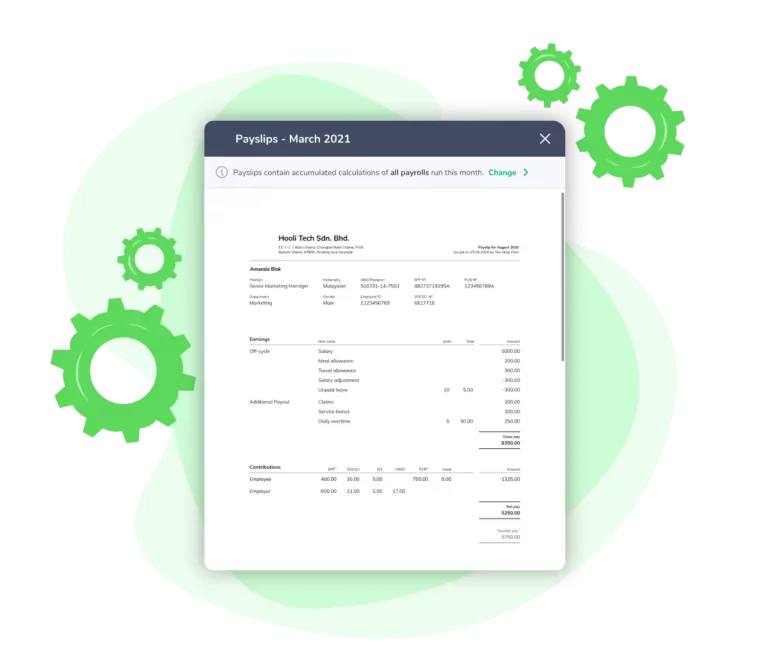

When setting up payroll, it’s important to include recurring items that consistently appear in each pay cycle. These typically include base salary or wages, which are the primary earnings of employees. Additionally, allowances (such as housing or transportation), benefits-in-kind (BIK), and commissions should be incorporated if applicable.

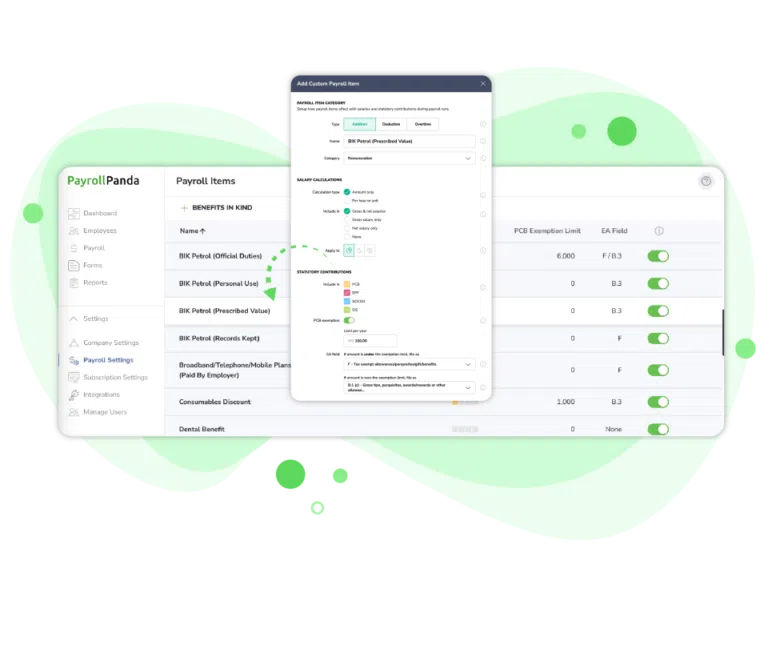

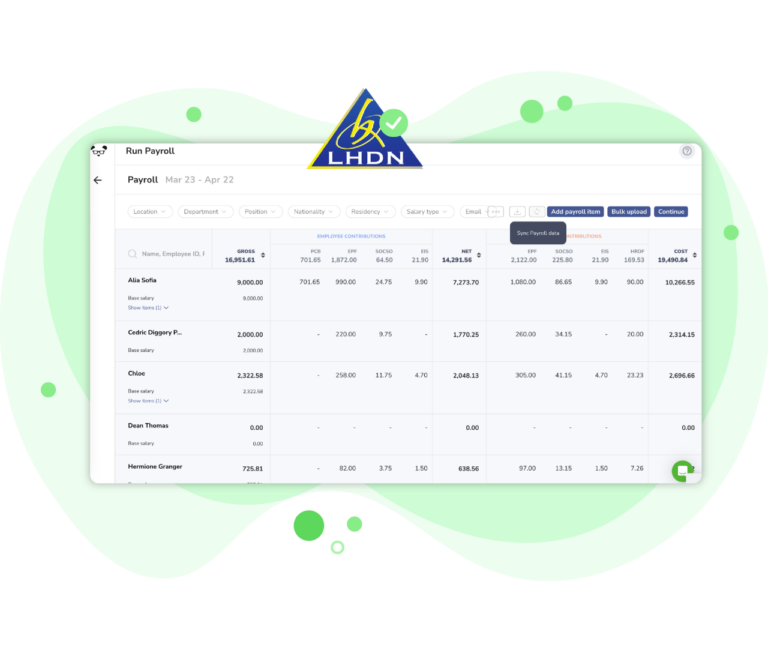

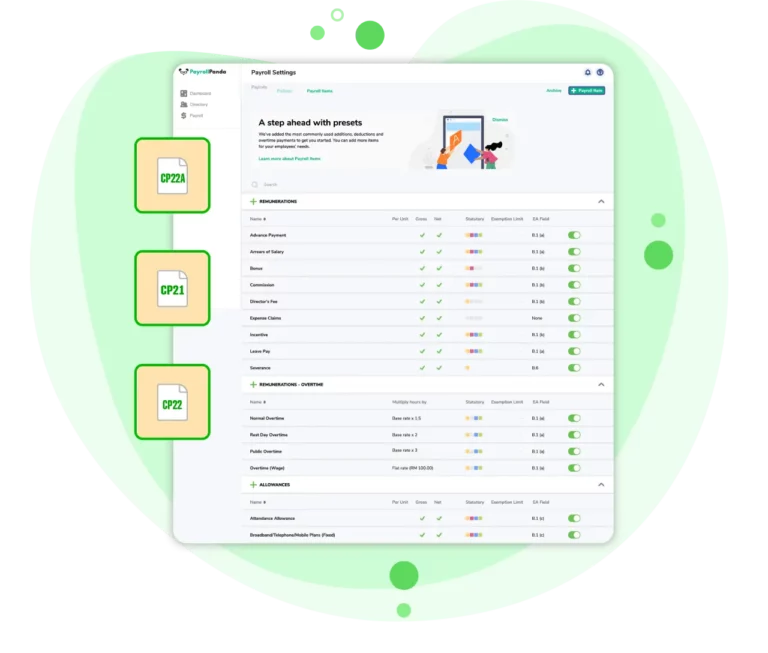

Recurring payments for payroll can be automated with the use of automated payroll software like PayrollPanda. This platform has over 80 preset payroll items that can be added to employee payroll including allowances, bonuses, commissions, deductions, and so on. These items can be set at a recurring frequency so they can be automatically added to every payroll run.

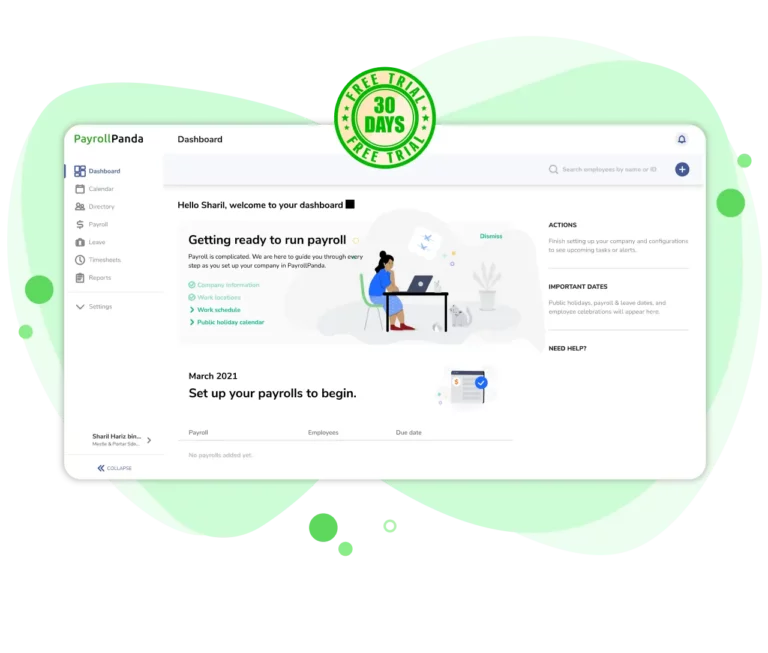

Getting started is easy! Simply sign up for free and you can begin streamlining payroll.

Yes, but only under specific conditions.

According to the Malaysian Employment Act 1955, which was updated on January 1, 2023, employers can make salary deductions only if they are authorized by the Act. Deductions can be made for reasons such as statutory contributions (SOCSO, EPF, EIS) or with the employee’s written consent for other specific cases. For any other deductions, you must seek approval from the Director General of Labour (DGL).