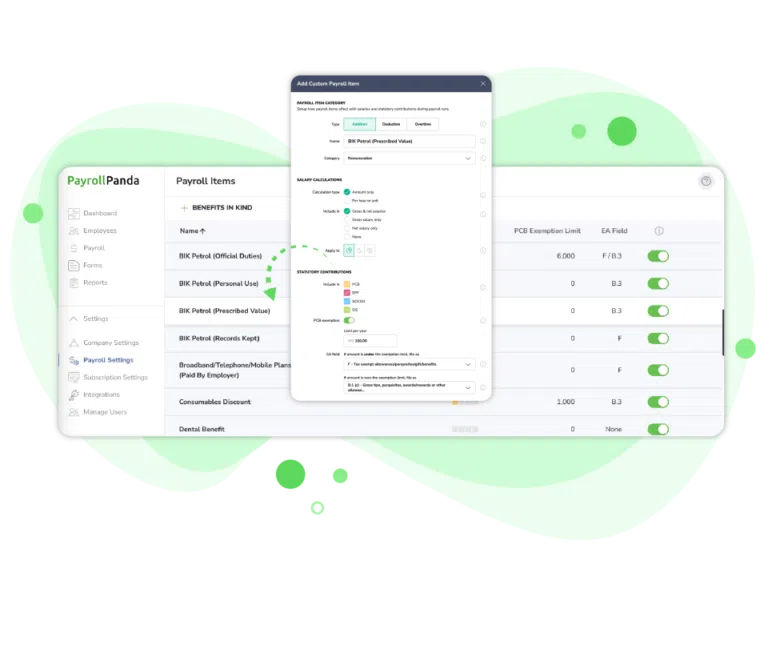

Payroll items are components of an employee’s compensation and deductions processed during payroll. Common payroll items include overtime pay, allowances, bonuses, and statutory contributions. The decision on which ones to include will vary on a case-to-case basis. When adding payroll items it’s important to review statutory regulations to ensure compliance with local labor laws and avoid legal issues.

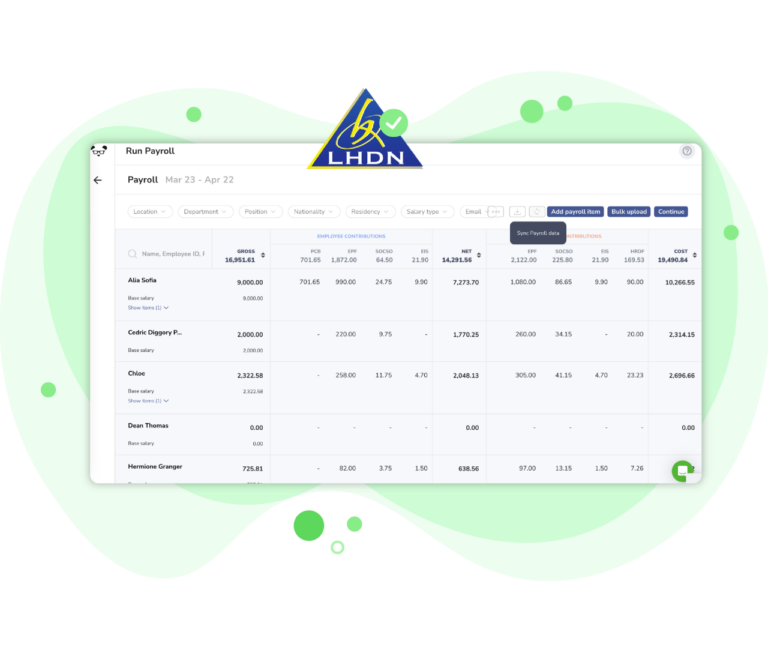

Yes, payroll deductions are allowed in Malaysia under specific conditions set by the Malaysian Employment Act. Employers can make statutory deductions such as EPF contributions and SOCSO premiums. Other deductions, like loan repayments or advances, must be authorized in writing by the employee. Any additional deductions not covered by the Act require approval from the Director-General of Labour (DGL).

Yes, PCB (Potongan Cukai Berjadual) calculations can definitely be automated. Payroll software like PayrollPanda can automate PCB calculations based on the latest tax tables and regulations. This automation ensures accurate calculations for monthly tax deductions from employees’ salaries, taking into account factors like tax exemptions, reliefs, and rebates.

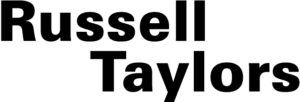

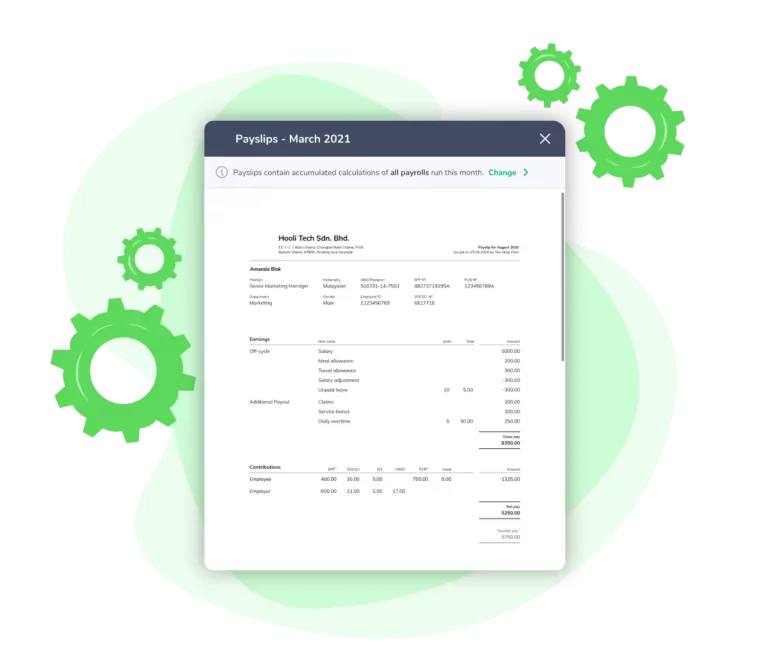

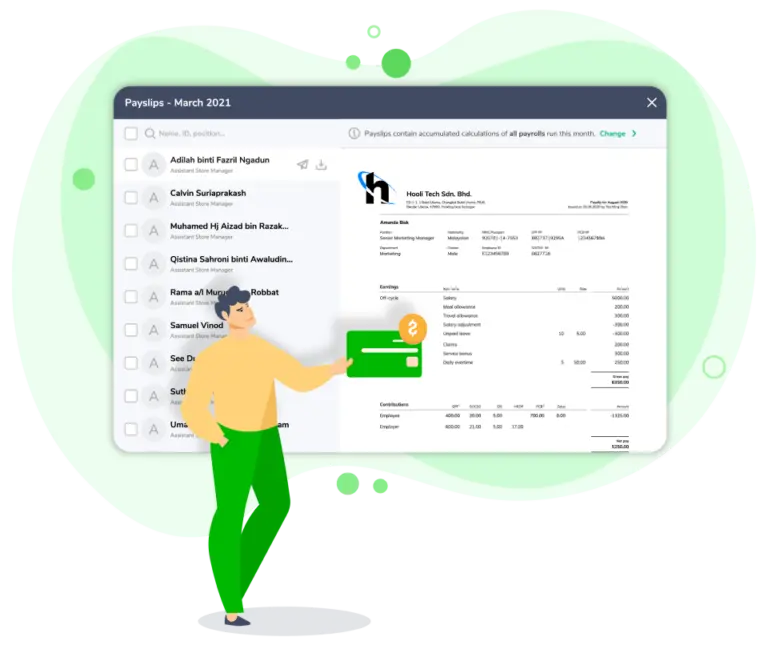

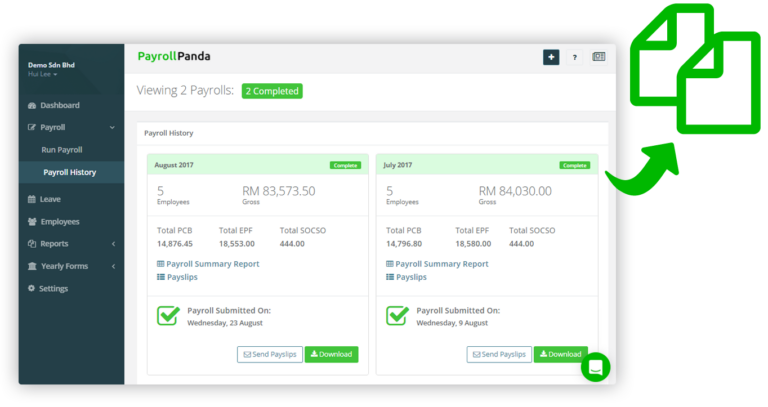

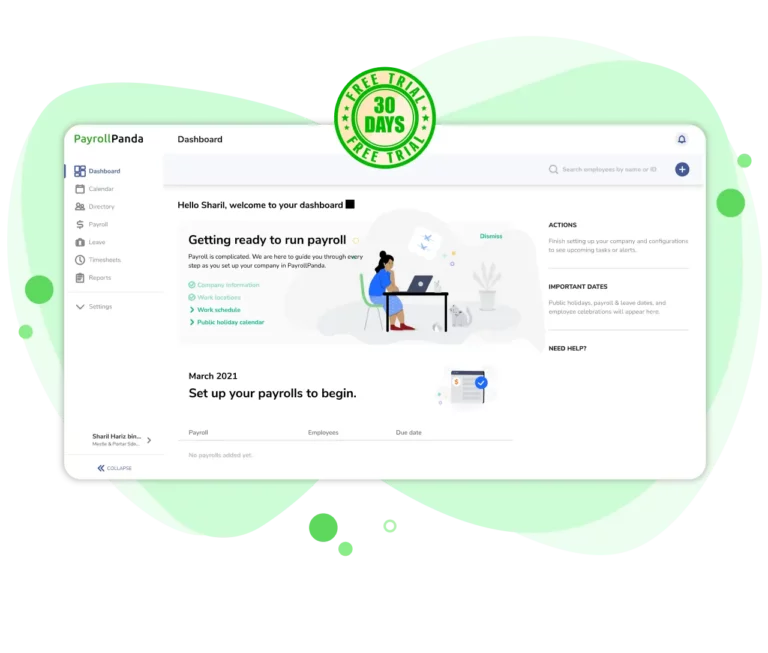

Yes! PayrollPanda is a 100% FREE payroll software that comes with over 80 preset payroll items, including commissions, allowances, and arrears. Plus, it offers the flexibility to create custom payroll items as needed. You can even set these items as recurring in your payroll runs, ensuring that nothing is overlooked when processing employee salaries.