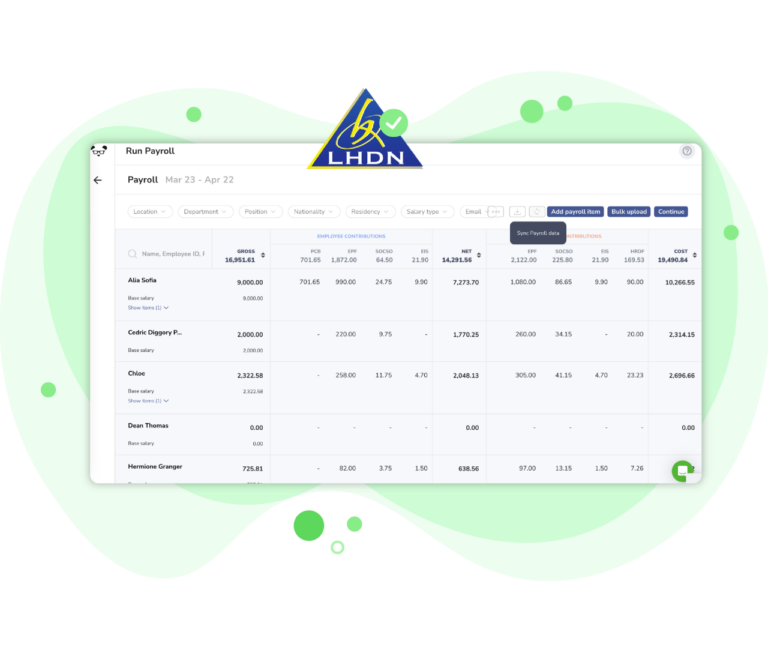

Non-compliance in payroll can result in significant penalties. An incorrect tax return can lead to fines ranging from RM1,000 to RM10,000 and 200% of the tax undercharged. Failure to furnish an Income Tax Return Form can result in penalties of RM200 to RM20,000, six months imprisonment, or both.

For statutory compliance, you need to keep sufficient records for seven years, including all documents affecting income tax liability. These records must be in Malay or English and retained in Malaysia unless approved otherwise by the Director General. Other required documents include various financial and tax-related files as stipulated by the Income Tax Act.

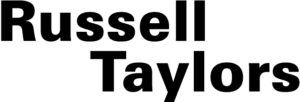

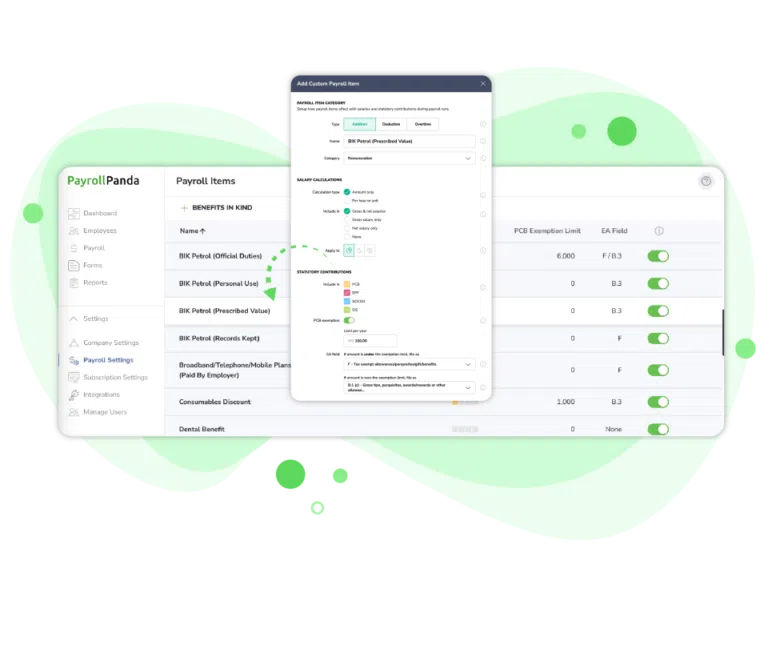

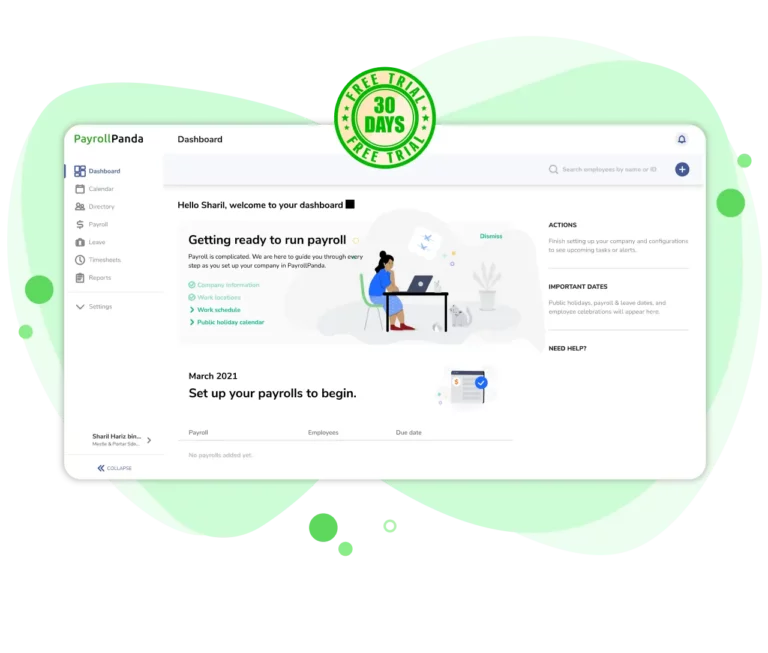

Yes, you can automate statutory payroll contributions. PayrollPanda can automatically calculate and deduct contributions for SOCSO, EIS, EPF, PCB, and HRDF/HRDCorp from employee payrolls. Simply set your payroll parameters, and the system ensures accurate, compliant payroll processing.

The easiest way to ensure payroll compliance is by using automated payroll software that’s statutory compliant like PayrollPanda.

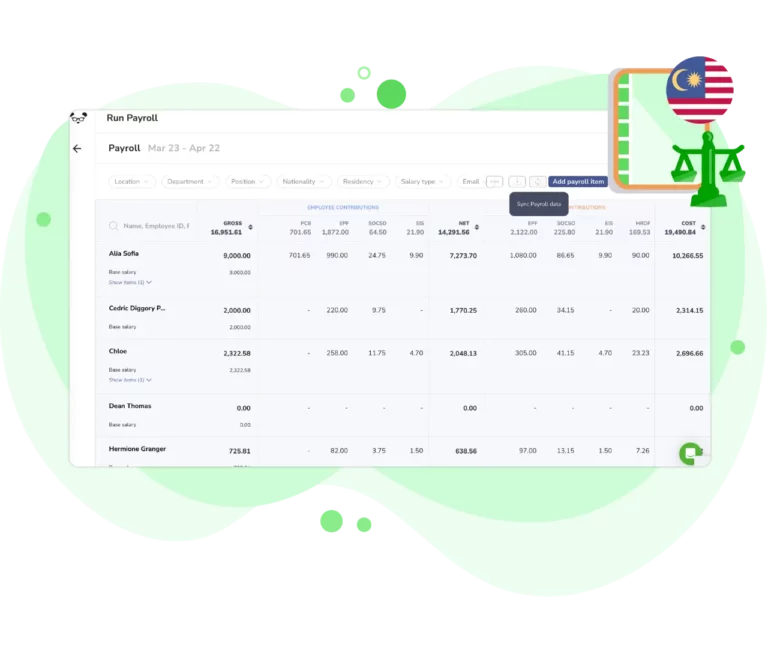

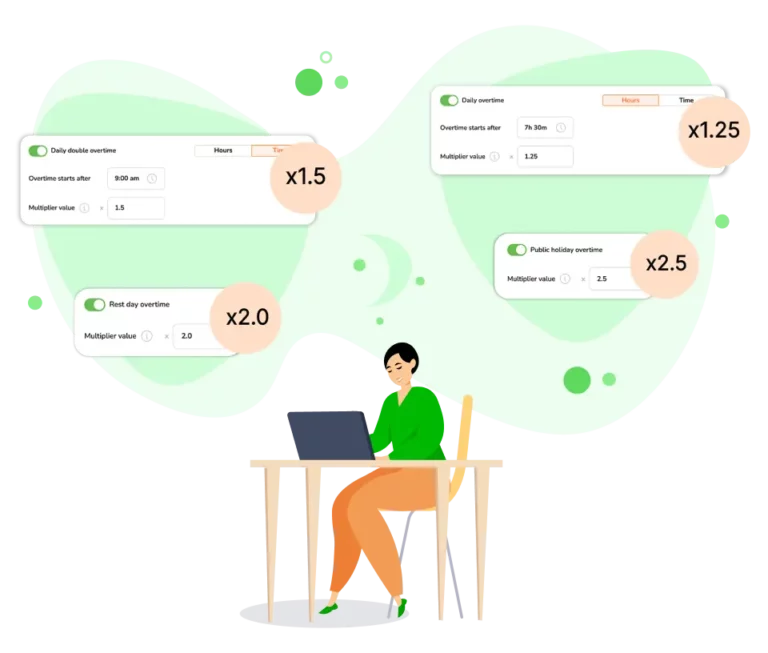

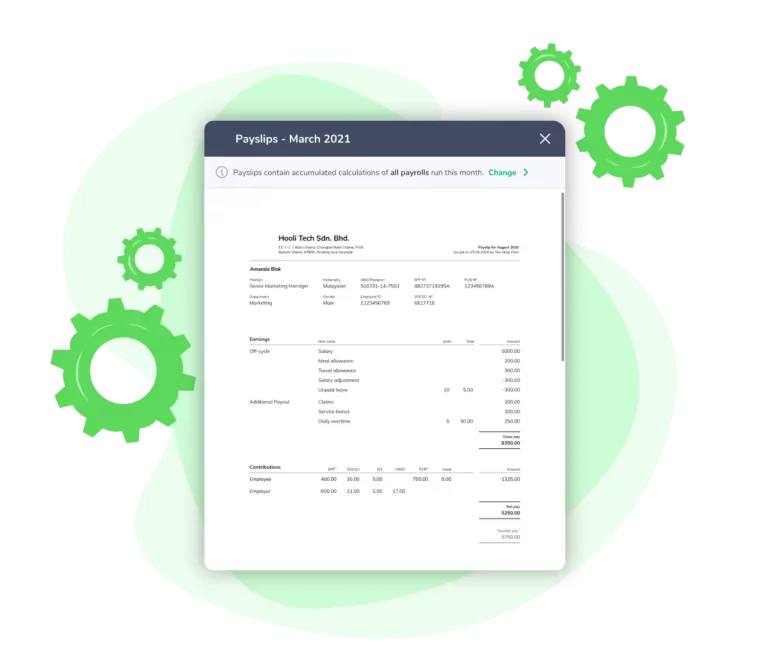

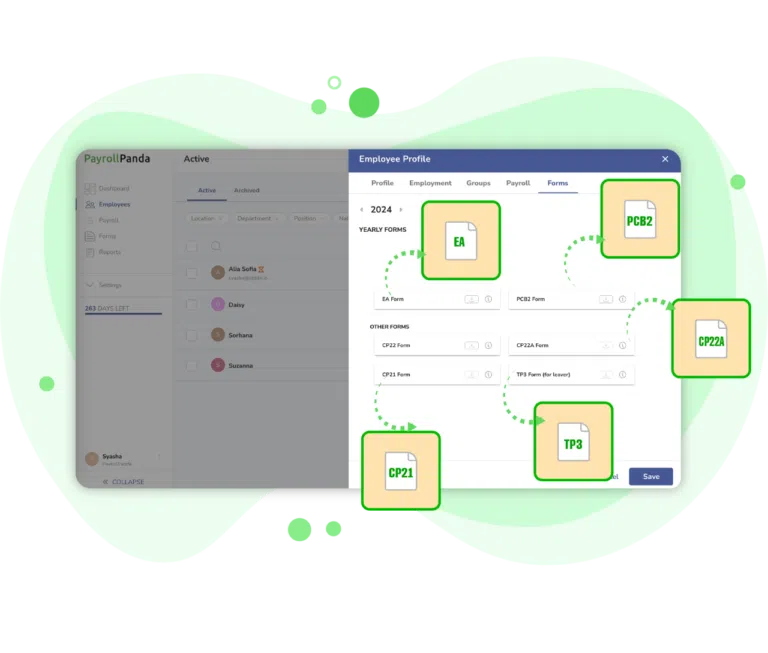

With PayrollPanda you can automatically calculate PCB and statutory contributions according to Malaysian tax rules. It also manages mandatory contributions with automatic deductions, sets up recurring payments for preset payroll items, and accurately computes overtime pay. Additionally, PayrollPanda generates statutory forms and audit files, should you need them, for easier compliance.