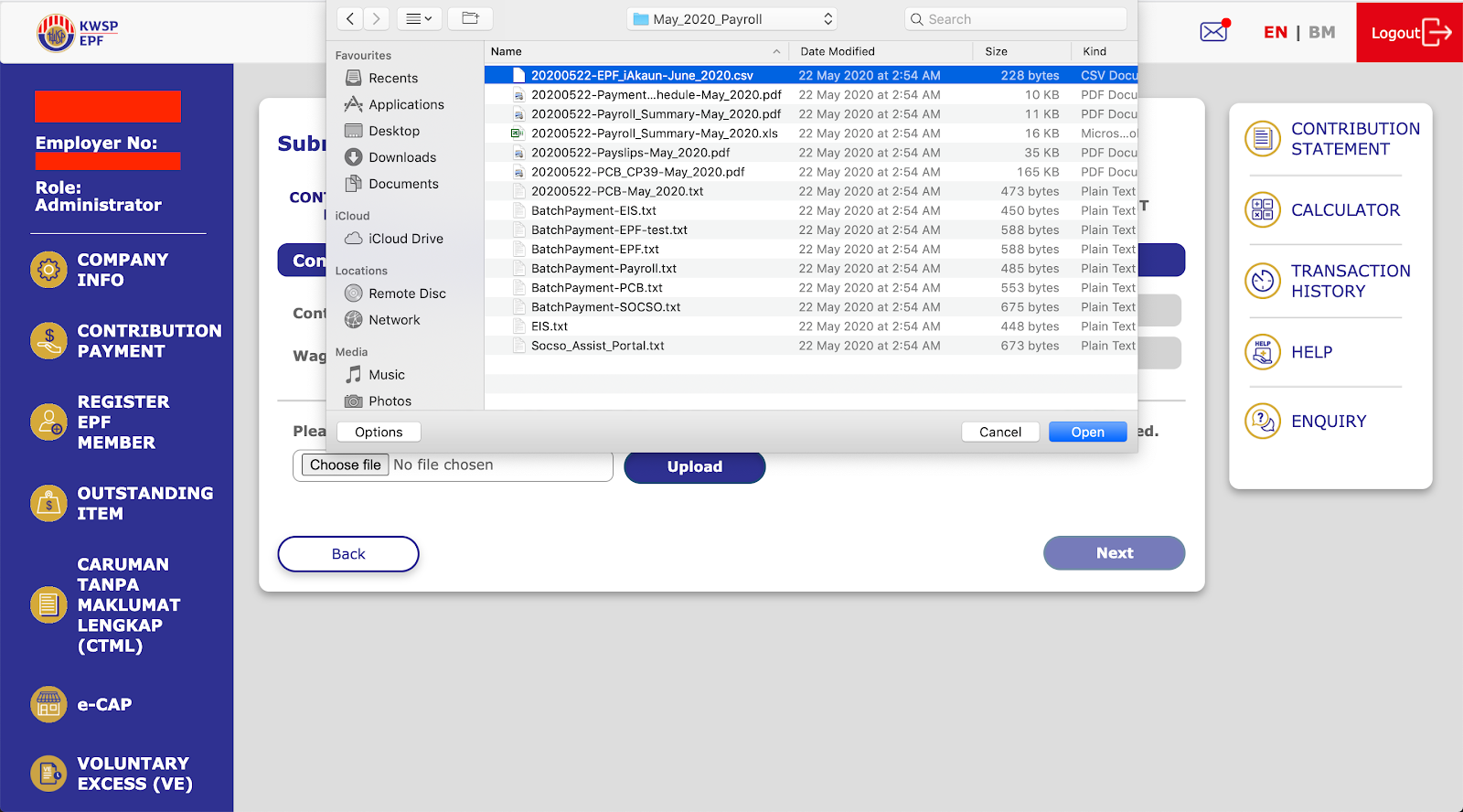

Once your payroll is submitted in your PayrollPanda account, the EPF file (EPF_iAkaun.csv) will be among the downloadable files and can be uploaded to your i-Akaun to submit contribution details (form A) to KWSP.

Login to your employer i-Akaun.

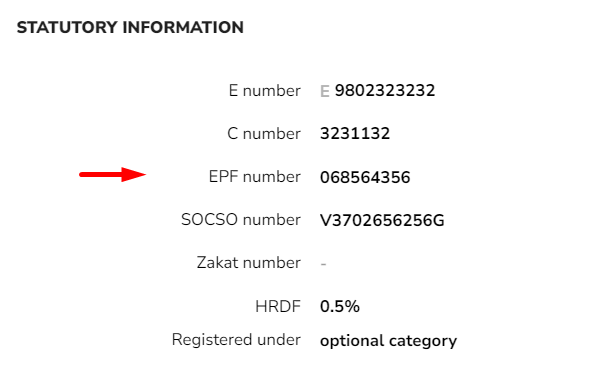

1. Use the employer EPF number as your User ID and your password to login.

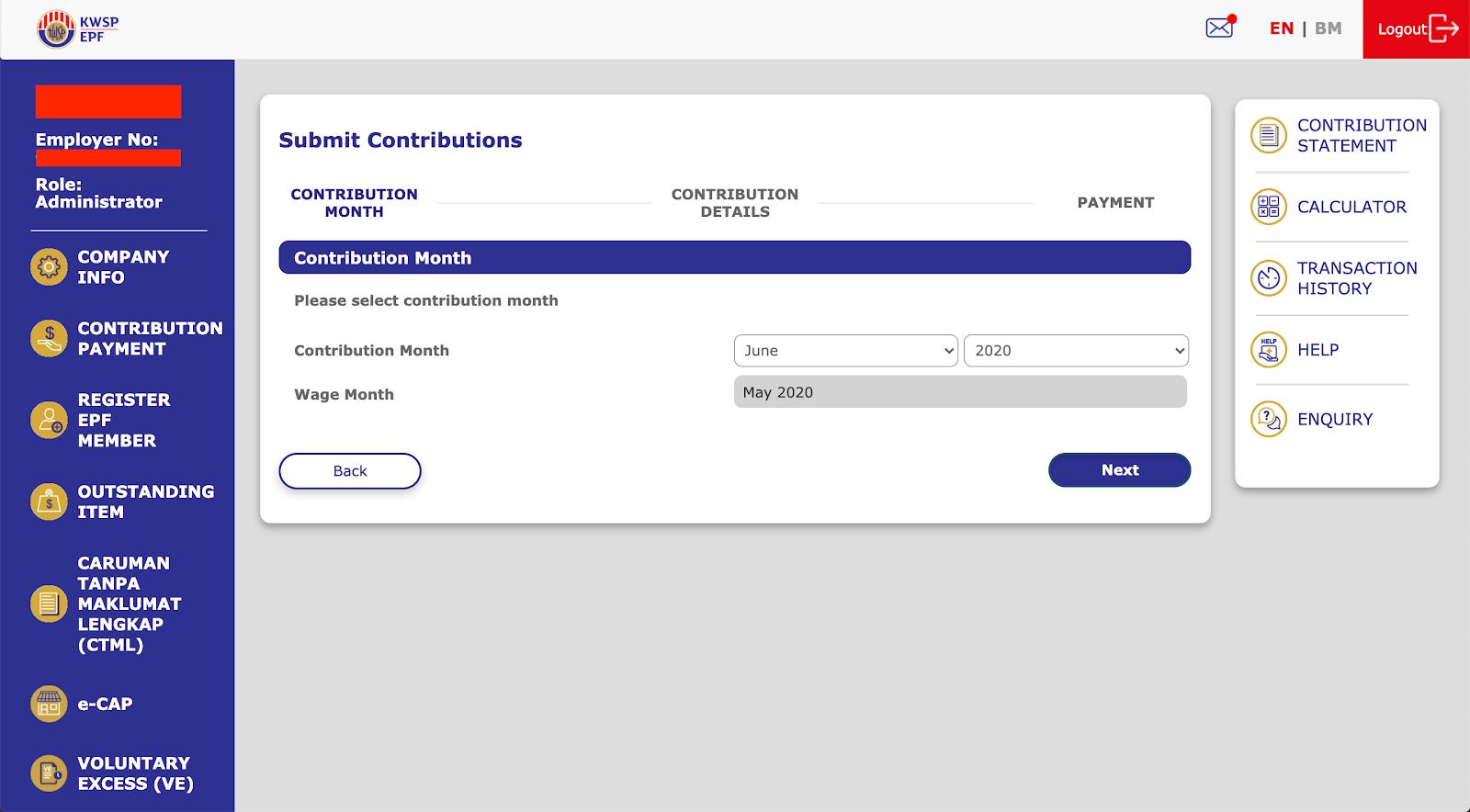

2. On the left side select “Contribution Payment”, and then “Submit Contributions”.

3. You will need to select the correct contribution month. IMPORTANT: Please note that the contribution month is always one month AHEAD of the salary month, eg: if you ran payroll for the month of May 2020, then the contribution month will be June 2020.

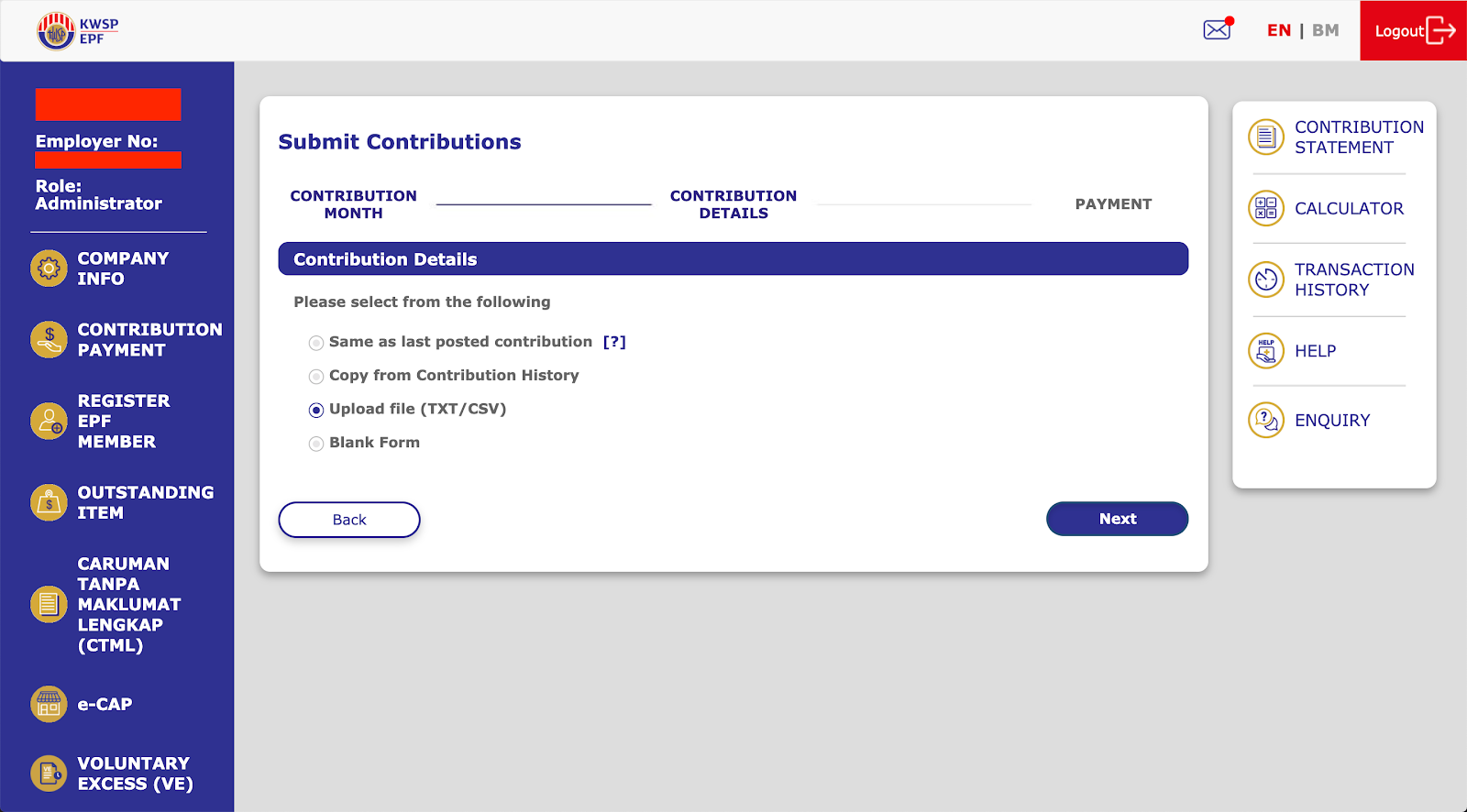

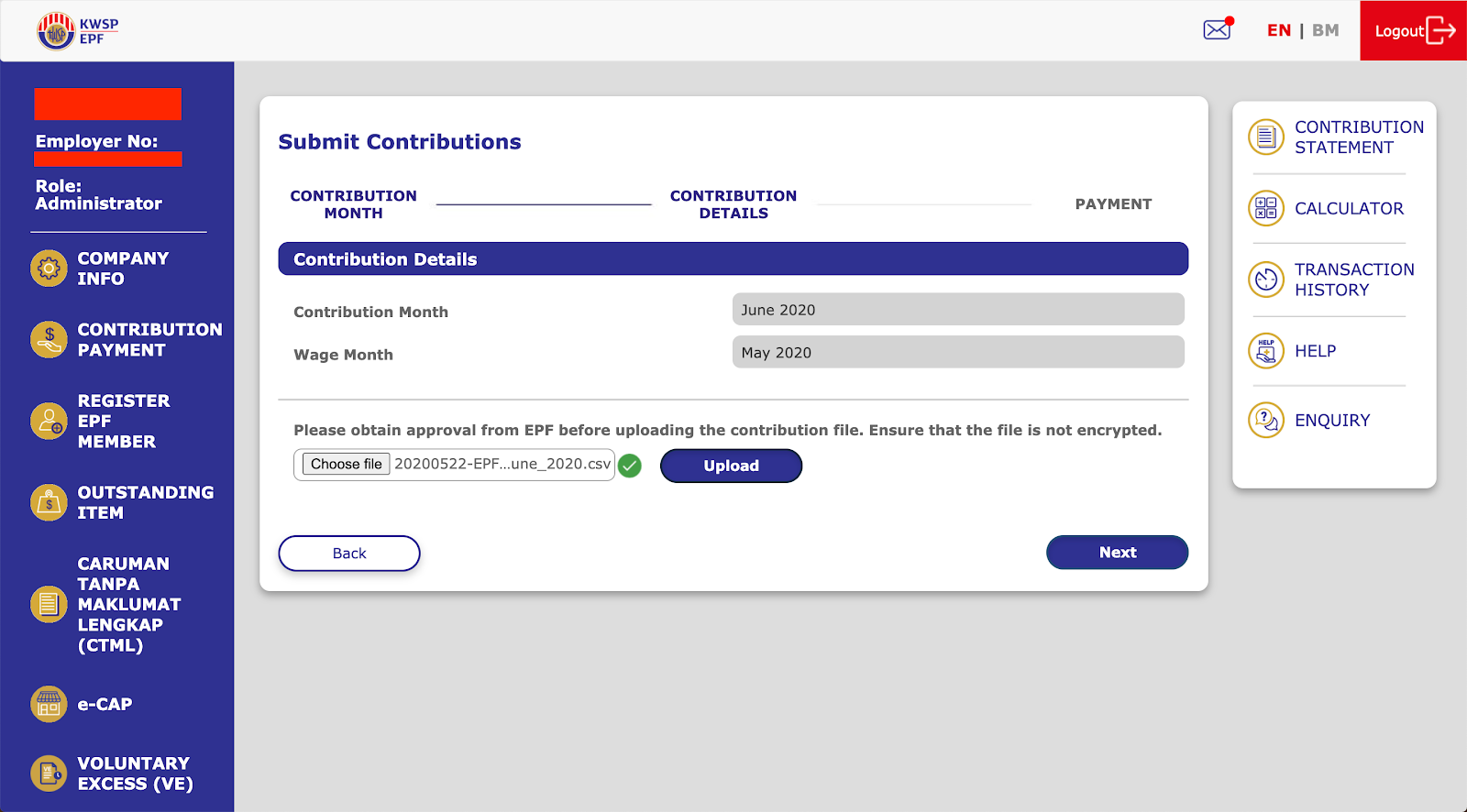

4. Then select “Upload file (TXT/CSV)” and upload the EPF .csv file to the system.

5. Once the file is uploaded click “Upload”, and then “Next”.

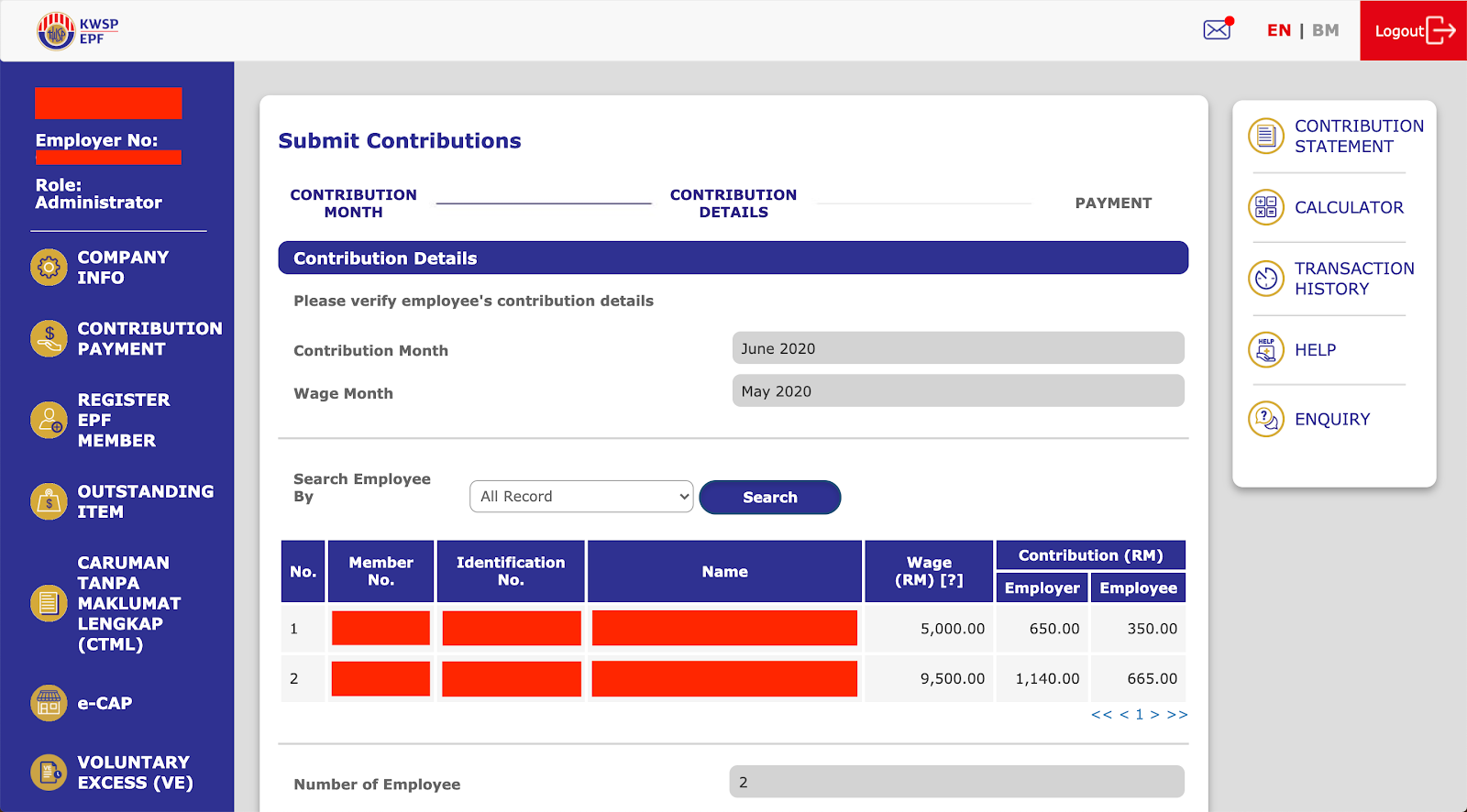

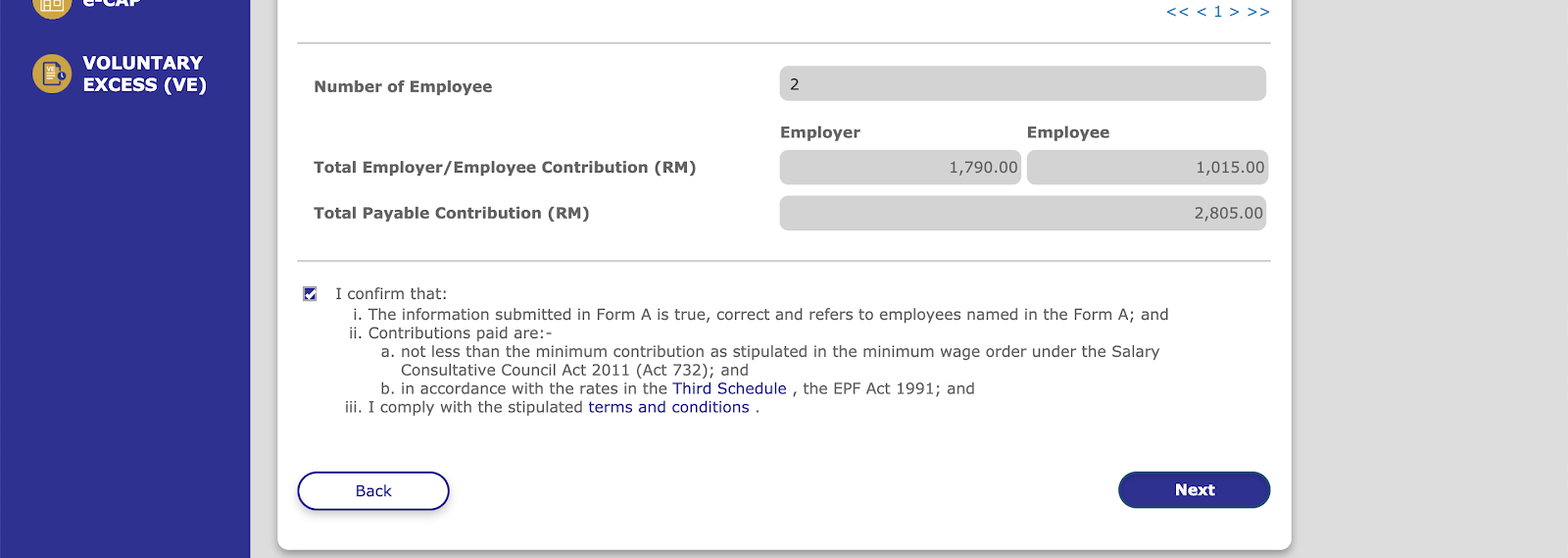

6. The list of employees with their respective contributions will appear, scroll down to the bottom of the page click “I confirm that:” and then “Next”.

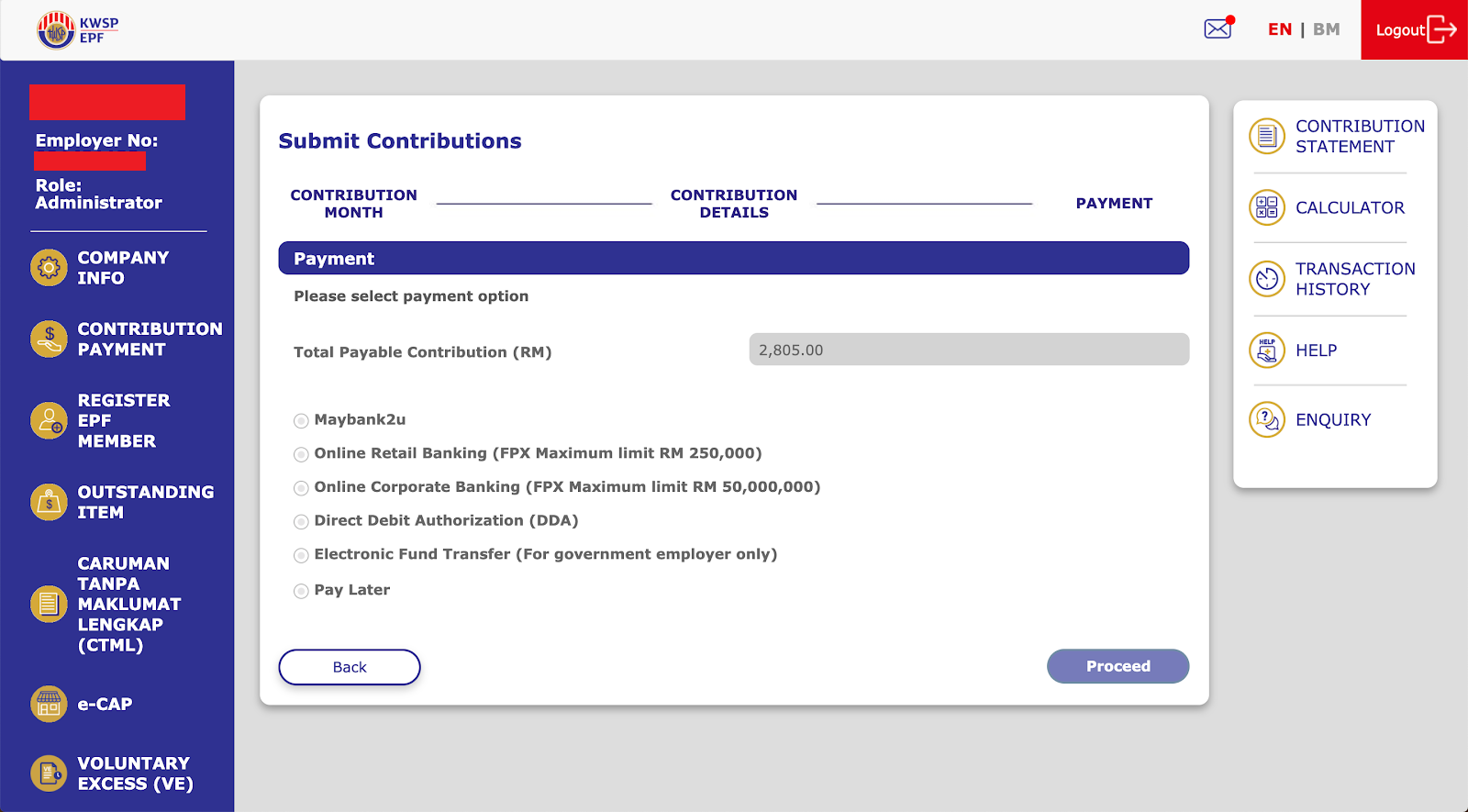

7. As the final step, you will need to select a payment method:

-

You can opt to pay directly via the bank website (currently only available for Maybank customers).

-

You can make payment via FPX (non-approval flow).

-

You can make payment via direct debit (only for employers who have registered DDA).

-

You can make payment via Electronic Fund Transfer (only for government employers).

Click on How do I pay EPF? to learn more about EPF payment.

Let our payroll software calculate all your contributions. Book a demo.