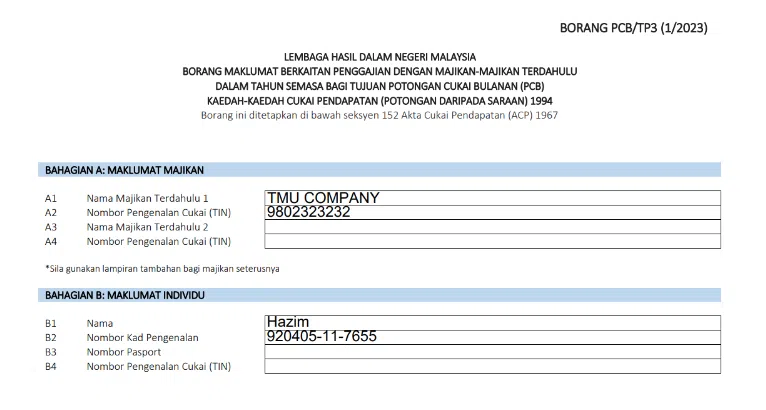

When an employee leaves your company, you can provide them with a TP3 form for leavers containing their current year payslip data paid by your company and any other previous employer. They will need to provide the form to their new employer if they are joining the new employer during the course of the year, so the new employer can calculate the PCB accurately based on their previous income and deductions paid in previous months of the year.

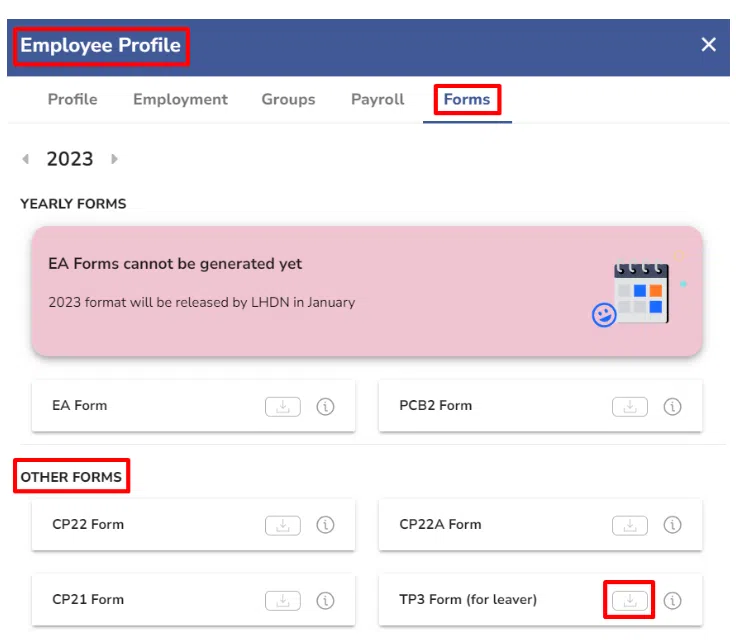

You should first archive the employee as the form can only be generated if the employee has been archived. You can then download the TP3 form for leavers under Employees > Archived > select employee > Forms > Other Forms by clicking on the Download icon for the TP3 Form (for leaver).

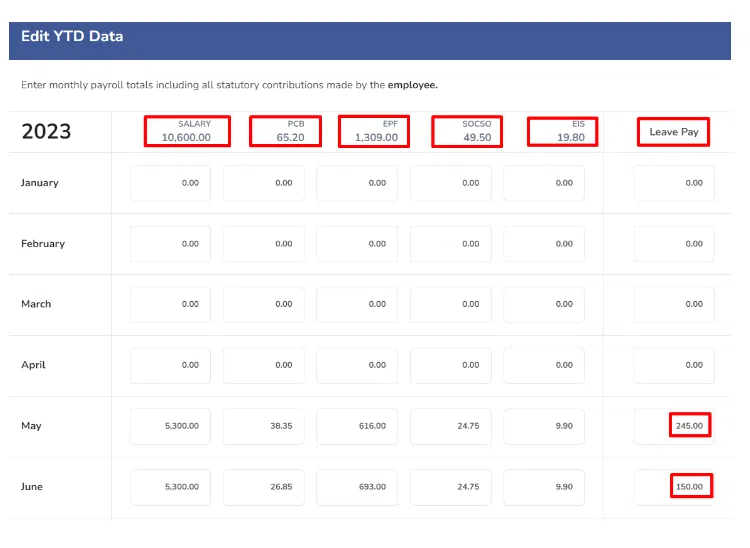

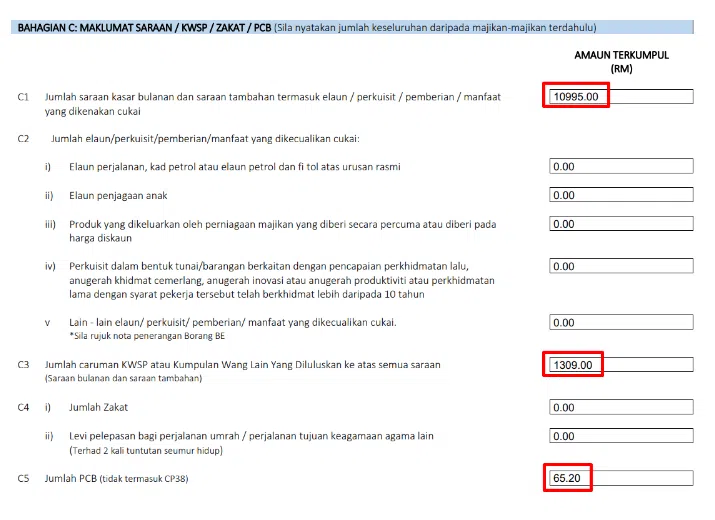

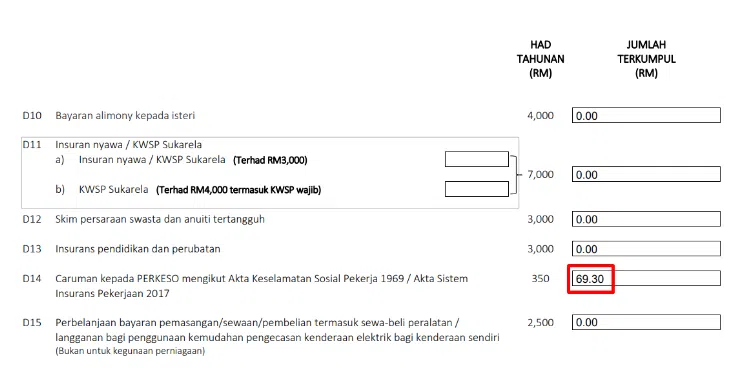

The amounts under Part C of the TP3 form for leavers are taken from the Monthly YTD Data table found under the Payroll tab in the employee’s profile.

If the employee is leaving your company in the same year they joined your company, any income and deduction amounts paid by any previous employer this year before joining your company and entered in their TP3 form under the Payroll tab in their profile will also be included in their TP3 form for leaver, together with the amounts paid by your company under the Monthly YTD Data table.