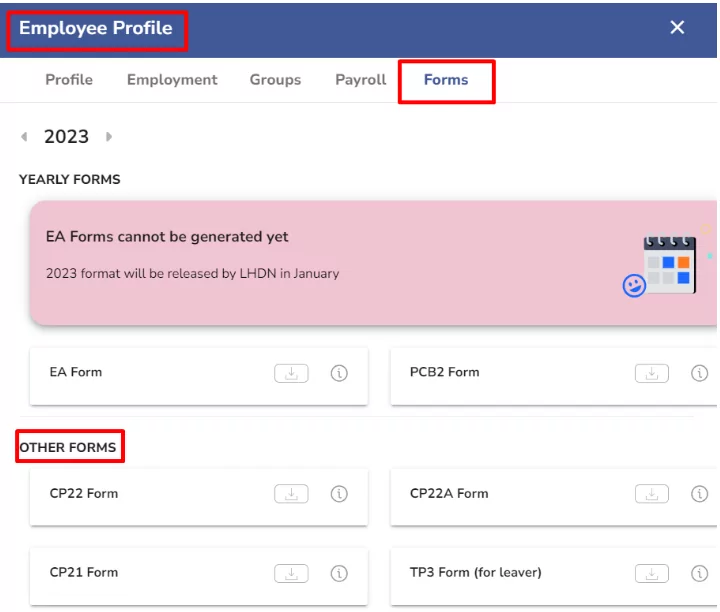

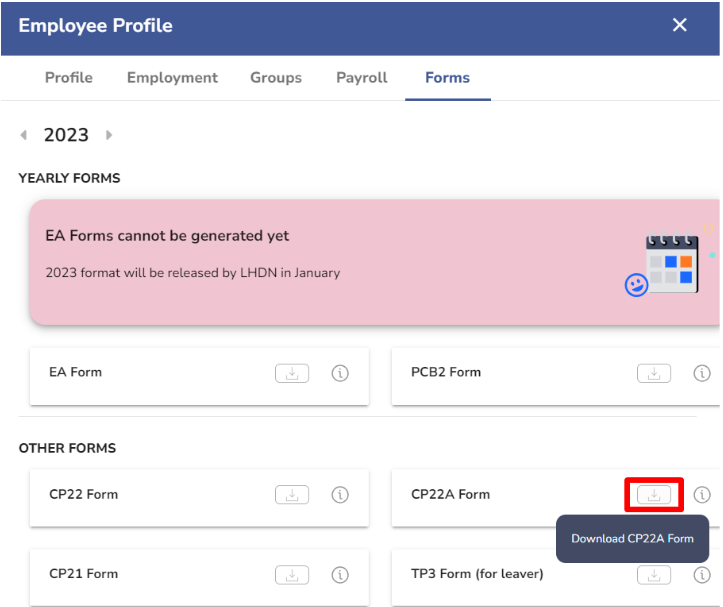

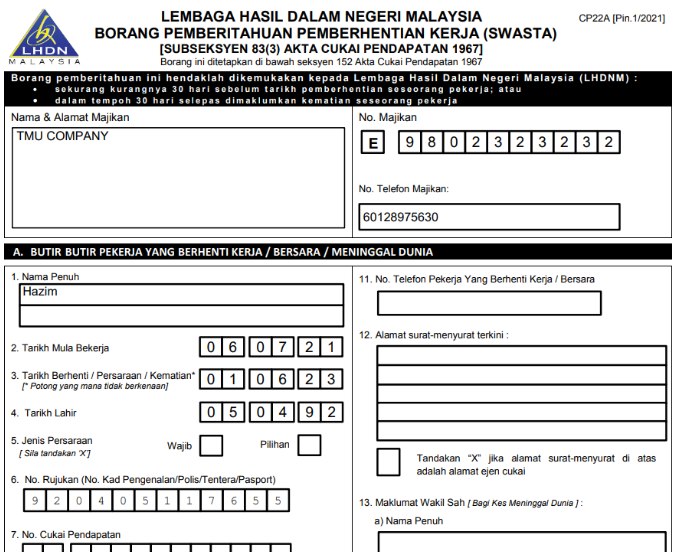

CP22A must be submitted with LHDN when an employee is leaving your company. Please note that you do not need to submit form CP22A if the PCB was deducted correctly or the employee’s salary was below the PCB threshold, and the employee is not retiring. You can download the CP22A form in PayrollPanda under Employees > select employee > Forms > Other Forms.

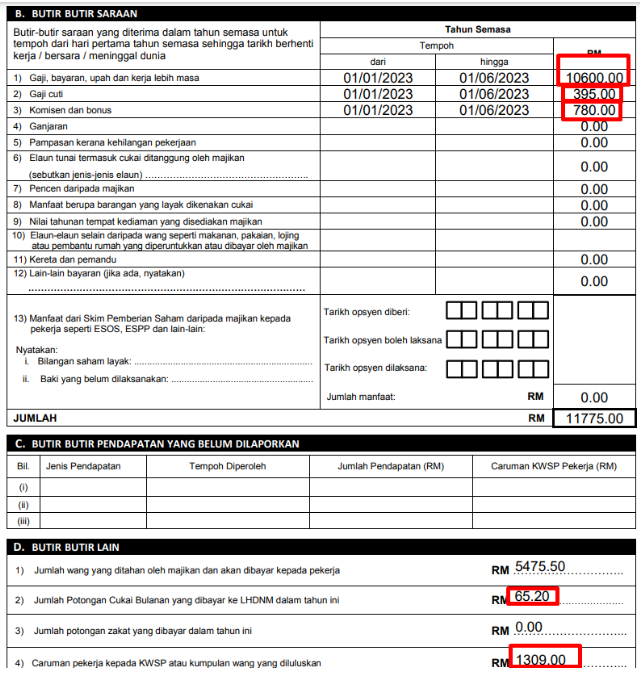

Please note that the amounts in category B will be taken from the YTD table found under the employee’s Payroll tab, so the employee’s last month payroll should be approved if you want to include the amounts in the CP22A. The net pay withheld in D1 is taken from the employee’s final payroll.