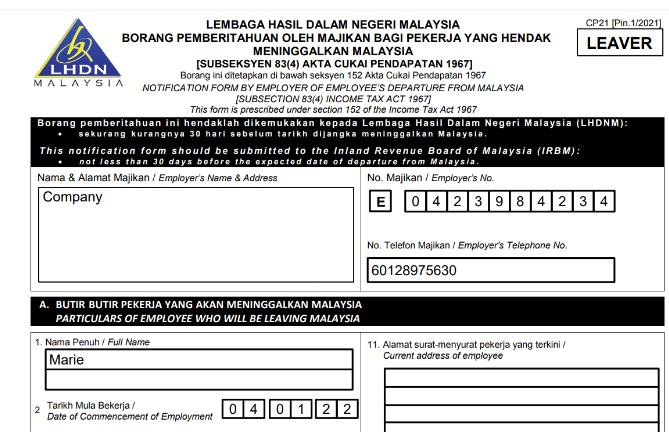

Form CP21 should be submitted to LHDN at least 30 days before departure for tax clearance of any employee leaving Malaysia for more than 3 months. Employers should also withhold any salary due to the employee for 90 days after submitting the form or until receipt of the tax clearance letter, whichever is earlier.

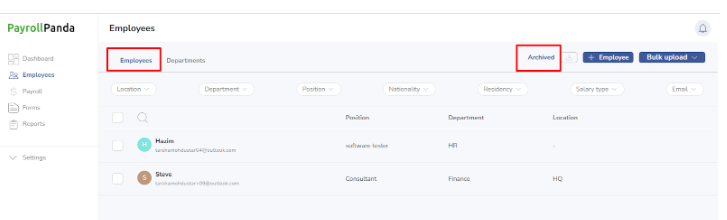

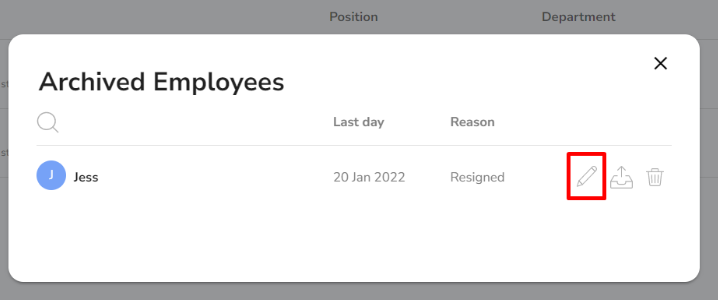

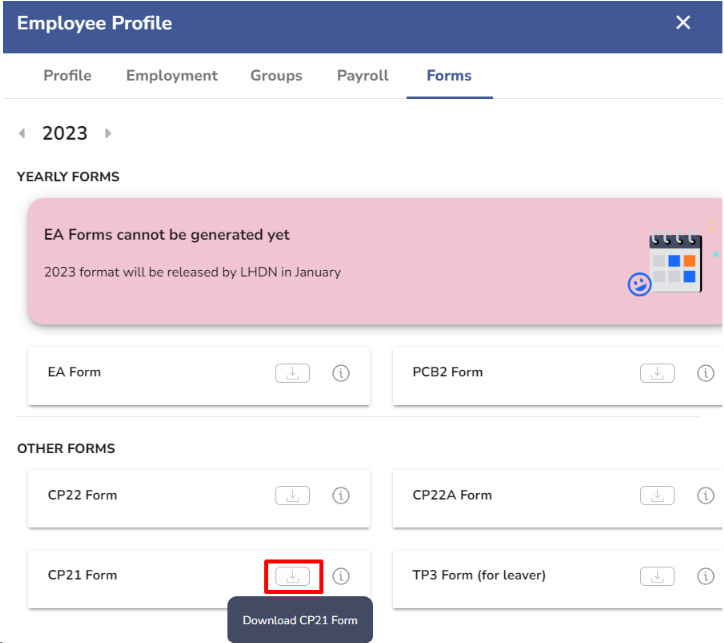

You can download the CP21 form in PayrollPanda the Forms tab in the employee’s profile. Please note that the form can only be downloaded if the employee has been archived.

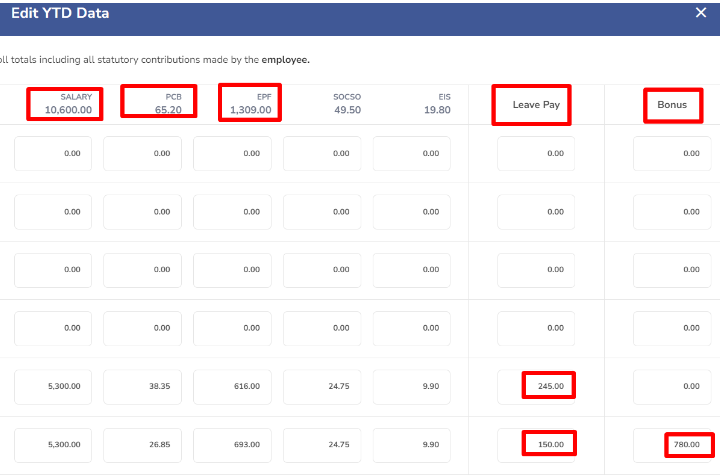

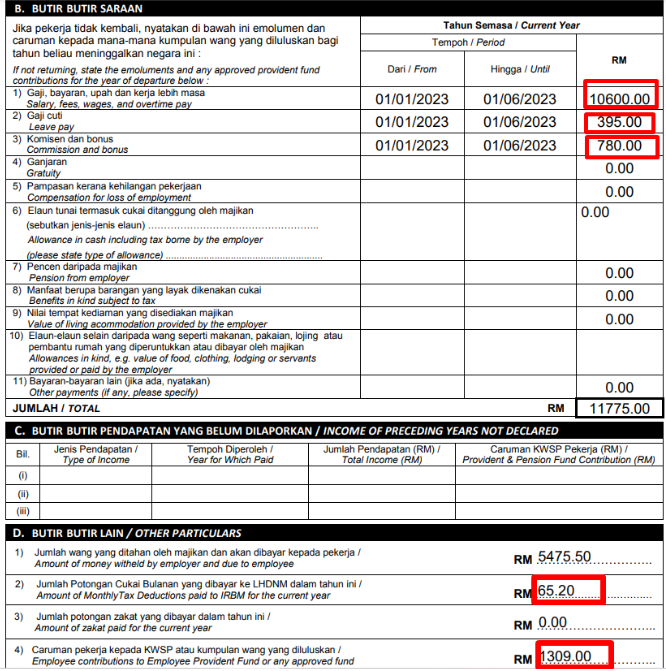

Please note that the income amounts in section B and contribution amounts in section D will be taken from the YTD table found under the employee’s Payroll tab so the employee’s last month payroll should be approved if you want to include the amounts in the CP21. The net pay withheld in D1 is taken from the employee’s final payroll.