Your new employees’ salary and statutory contributions paid by any previous employers in the current year should be entered in PayrollPanda, in order to obtain accurate PCB calculations.

Obtaining the data from your new employees

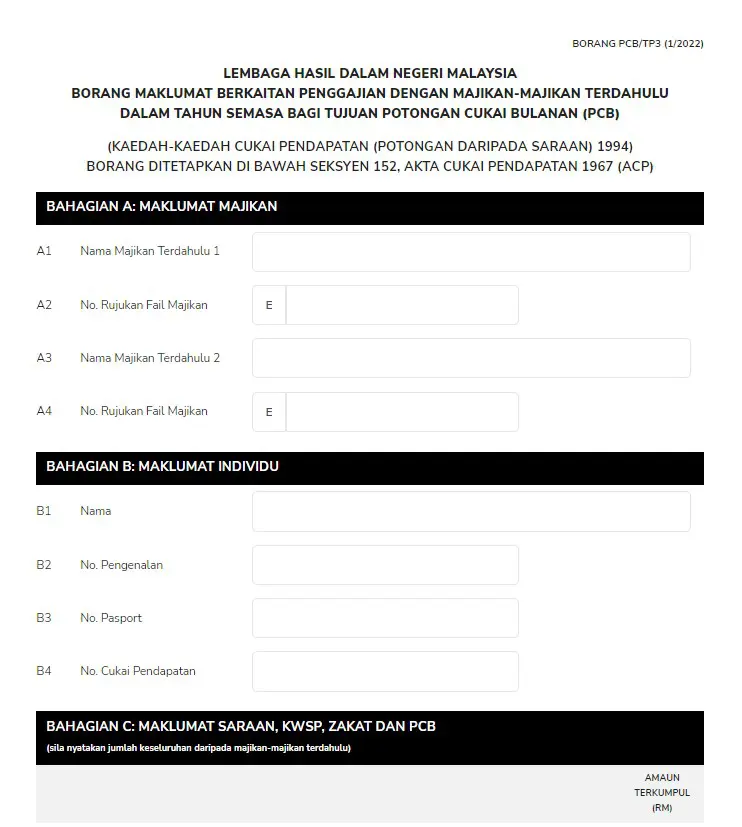

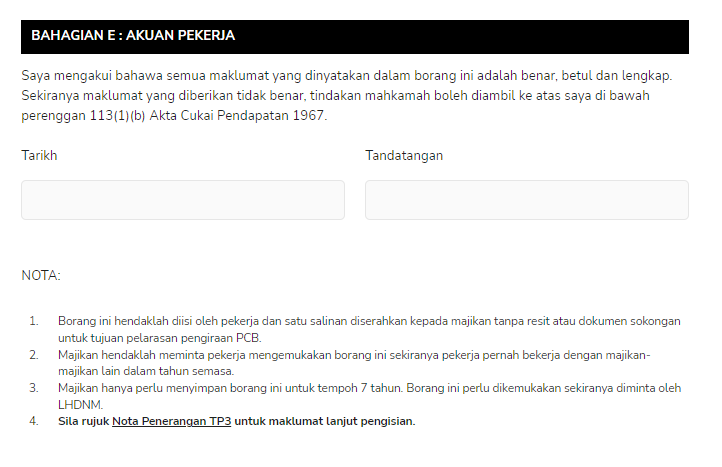

LHDN requires employers to ensure their employees complete and sign form TP3 to obtain current year previous employment salary information from their new employees when they start their employment. TP3 forms should be kept by the employer and only need to be provided to LHDN when requested during a PCB audit.

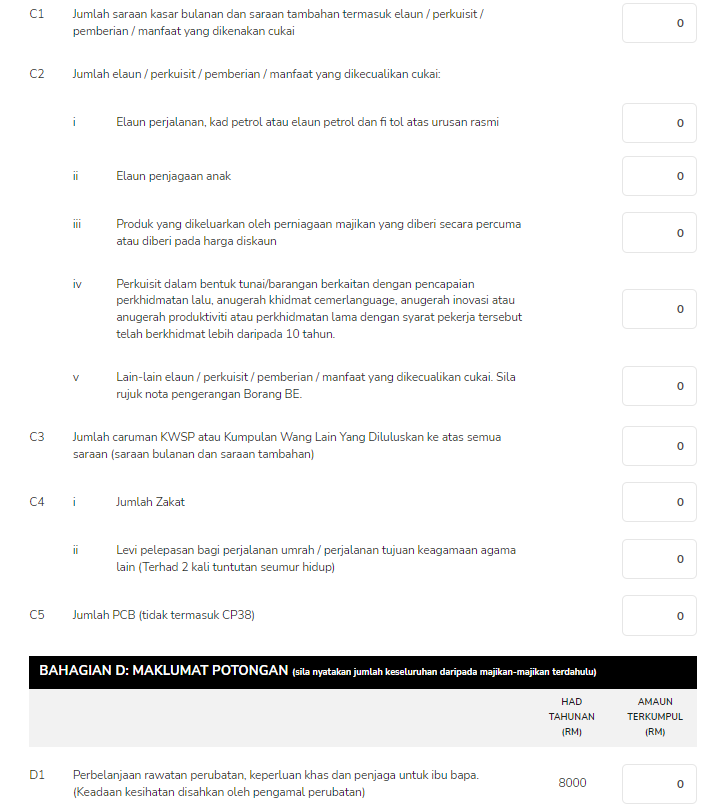

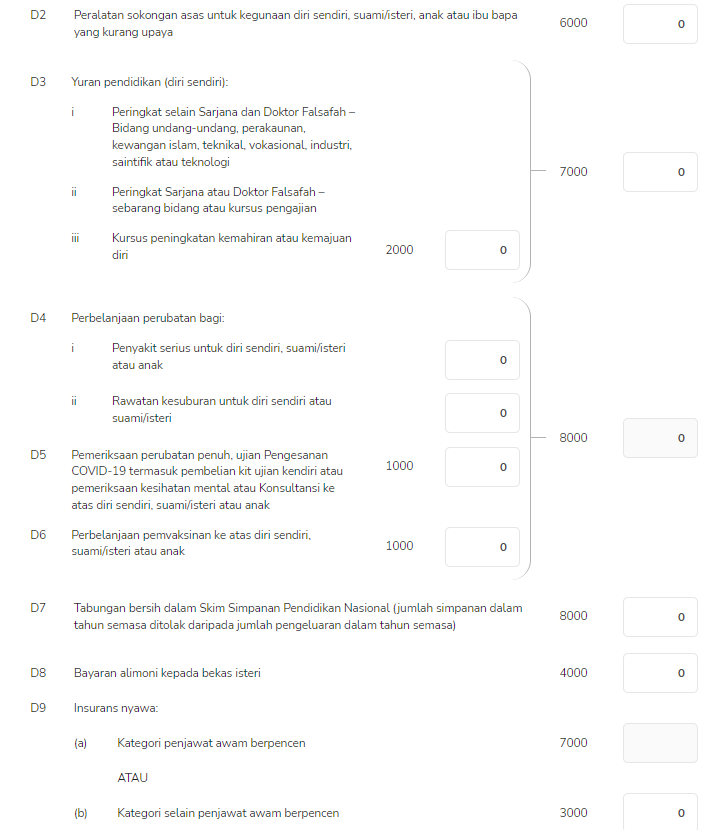

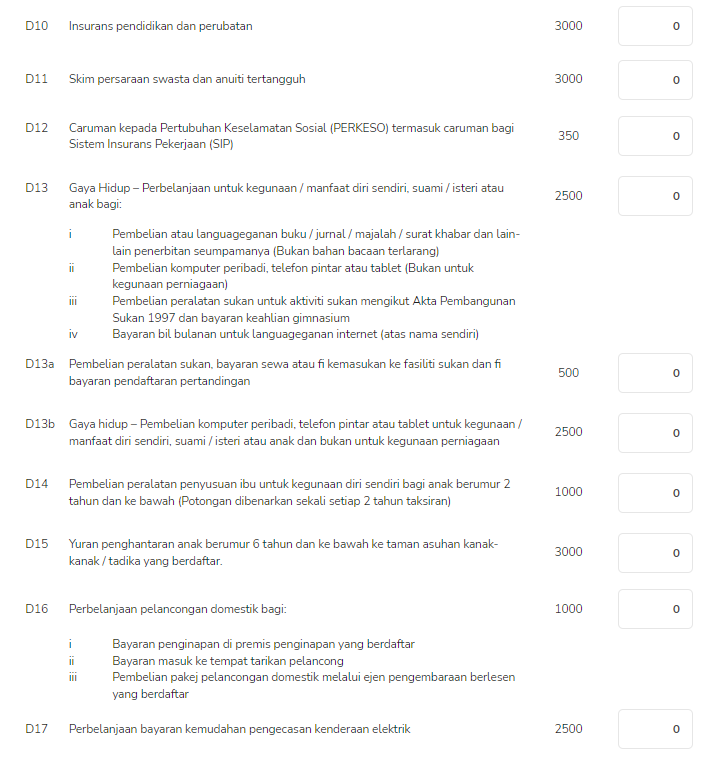

Please note that C1 in the TP3 form should include all fully taxable payments (including any commission, overtime, bonus, allowances, etc) received from any previous employers in the current year. C2 (i) to (iv) is for specific partially tax-exempt payments like travel allowance for official duties. C2 (v) is for fully tax-exempt payments. Enter any EPF employee contributions in C3, and SOCSO and EIS employee contributions in D12. The rest of part D should be filled if the employee claimed any tax deductions in the current year by submitting form TP1 to their previous employer.

If the employee was not previously employed during the year, they should enter 0 under C1 and sign the form.

Entering the data in PayrollPanda

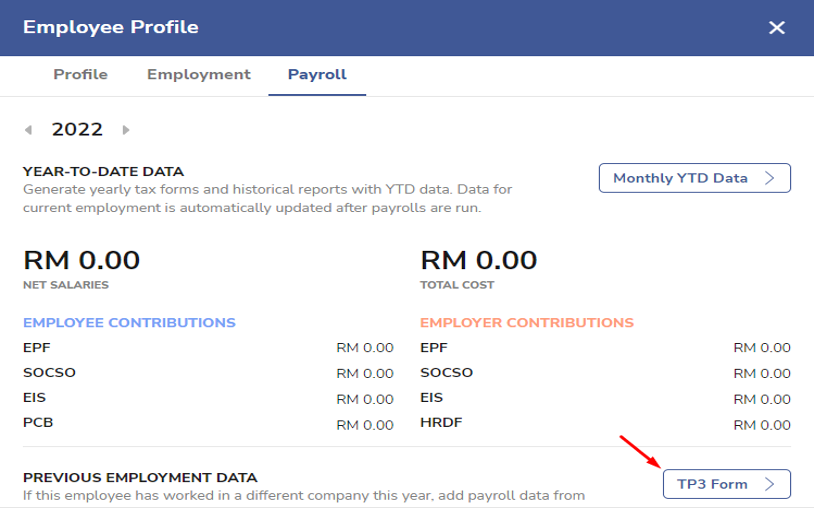

To enter the data, go to the Payroll tab in the employee’s profile and click on TP3 Form.

TP3 Form