PayrollPanda’s PCB calculations follow the formula specified by LHDN for payroll softwares. However, there may be times when employers may want to increase an employee’s PCB amount, for example if they already paid the PCB at a higher rate before running the payroll, or if the employee has other sources of income and they prefer to pay tax on that income via monthly deductions rather than in one lump sum when submitting their tax return. The amount entered as additional PCB will be added to the PCB calculated by PayrollPanda.

There are 2 preset additional PCB payroll deductions you can use, depending on the income being taxed:

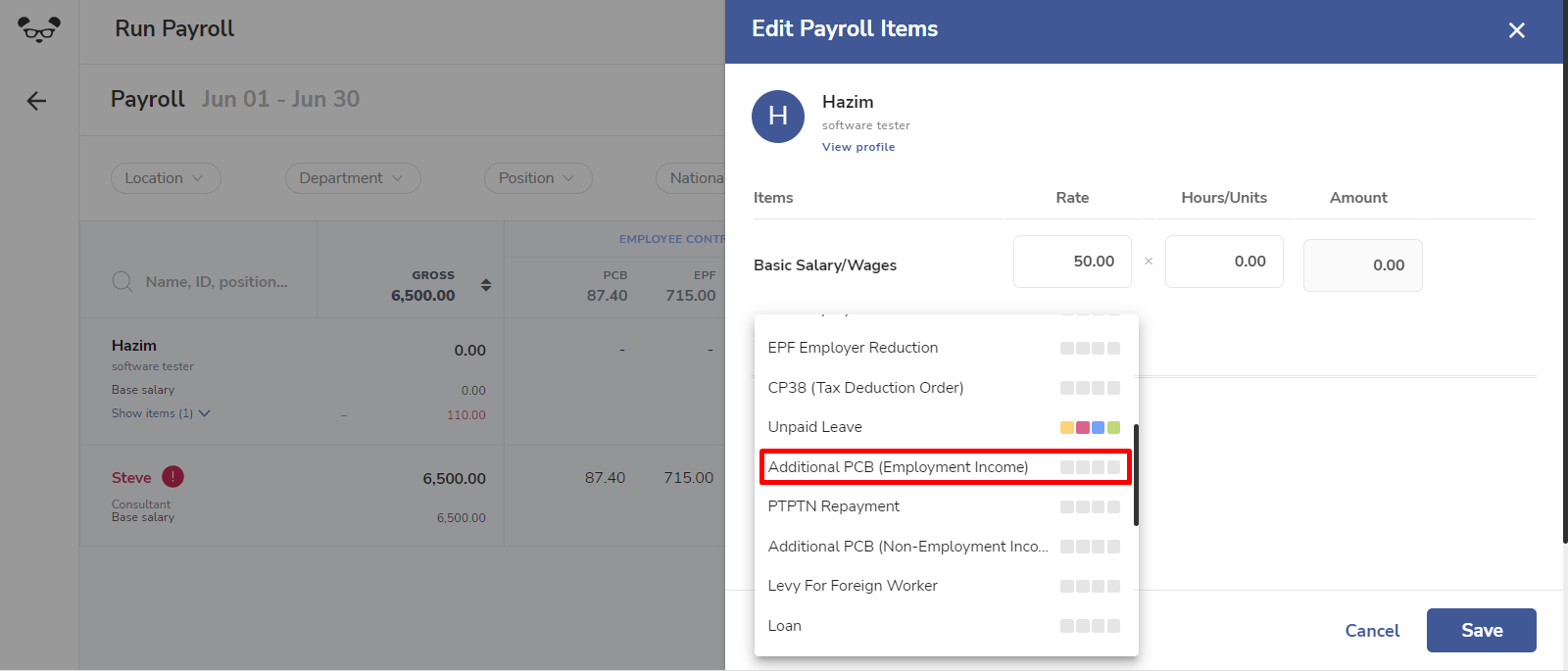

- Additional PCB (Employment income) should be used to pay additional PCB on the employee’s current employment income. The additional PCB will be taken into account as previously-paid PCB in the following months’ PCB calculations for the rest of the year.

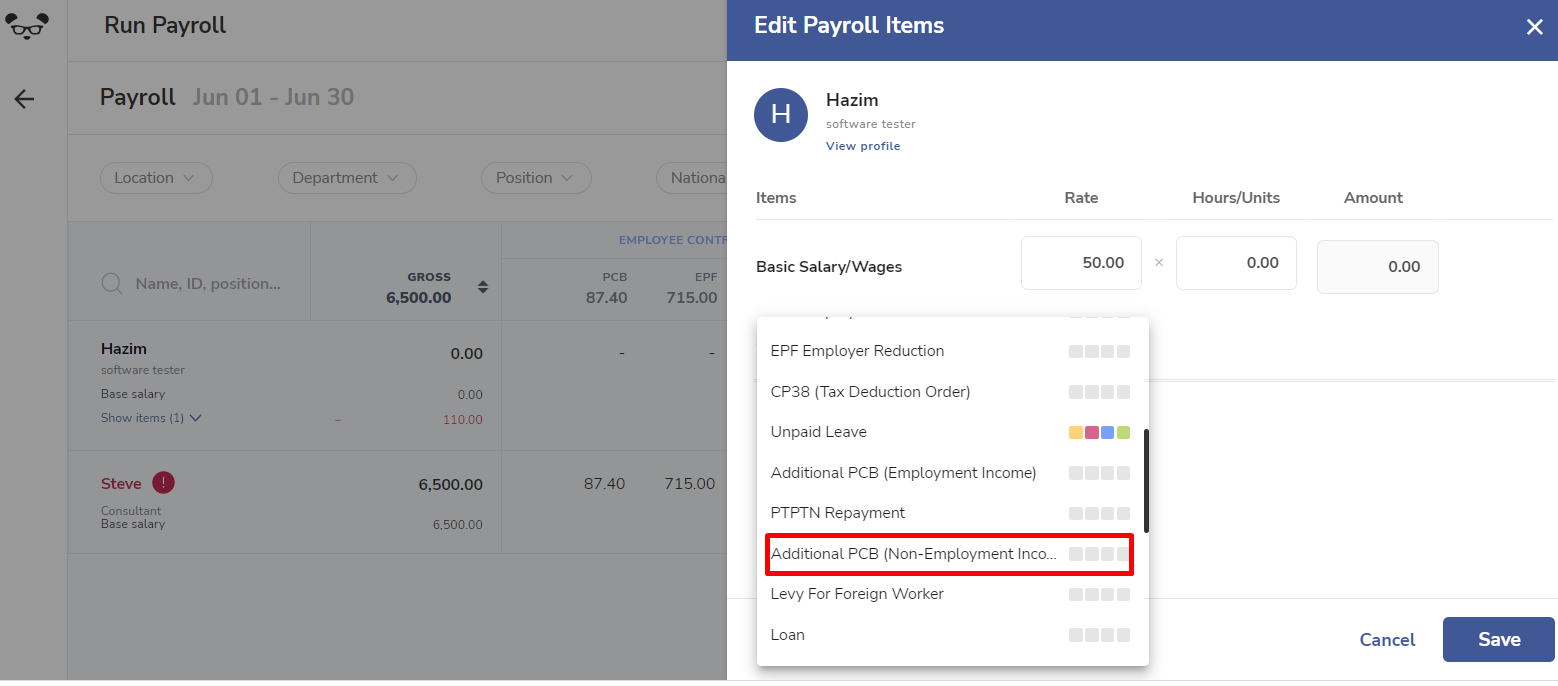

- Additional PCB (Non-Employment income) should be used to pay additional PCB on the employee’s non-employment income or income from other employments. The additional PCB will not be taken into account as previously-paid PCB in the following months’ PCB calculations, since it should not reduce the PCB on the current employment income.