You need to enter your company information to ensure that your employees’ payslips contain all the required details and that your salary and statutory files can be uploaded to the statutory/bank portals.

Go to Settings > Company Settings and enter your company information in the Profile tab, by clicking on the Pencil icons.

You will be able to find your company’s registration number on the following forms:

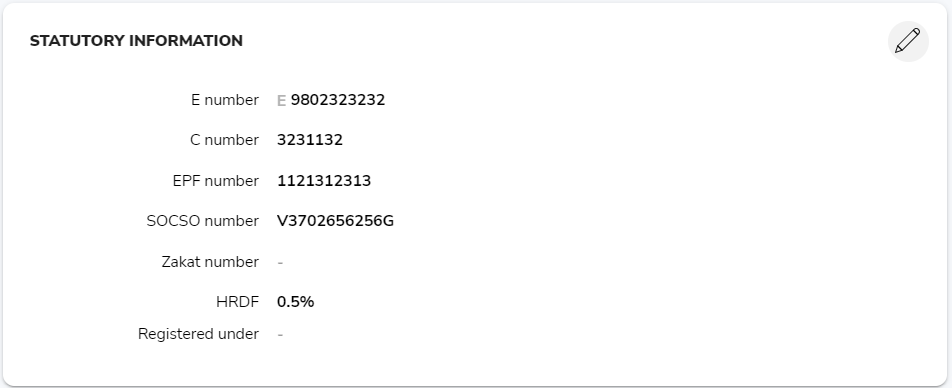

Your company’s E number can be found on the following forms:

Your company’s C number can be found on Form E. If your business is not a private company, you should enter your business’s income tax number. If you are a sole trader, that will be your personal tax number. If you are a partnership, it will be your D number.

Your company’s EPF number can be found on Borang A.

Your company’s SOCSO number can be found on Borang 8A.

If you have not yet registered as an employer with the statutory bodies, you can refer to this article for guidance.

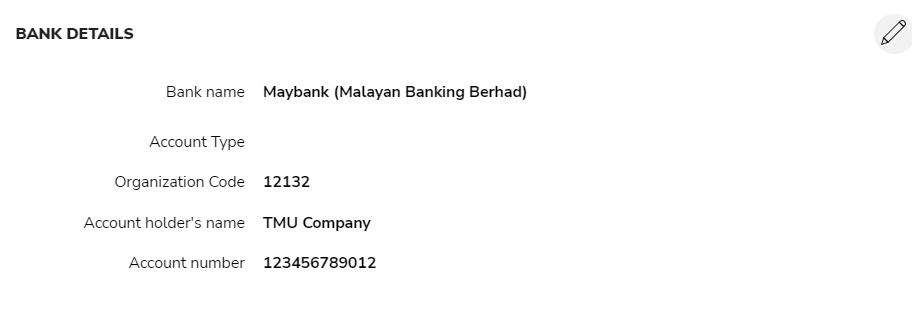

You will also need to enter your company’s bank details if you want to make your salary payments and/or statutory submissions and payments by uploading the bank files generated by PayrollPanda to your bank portal. For more information, please refer to this article detailing which banks PayrollPanda generates files for.