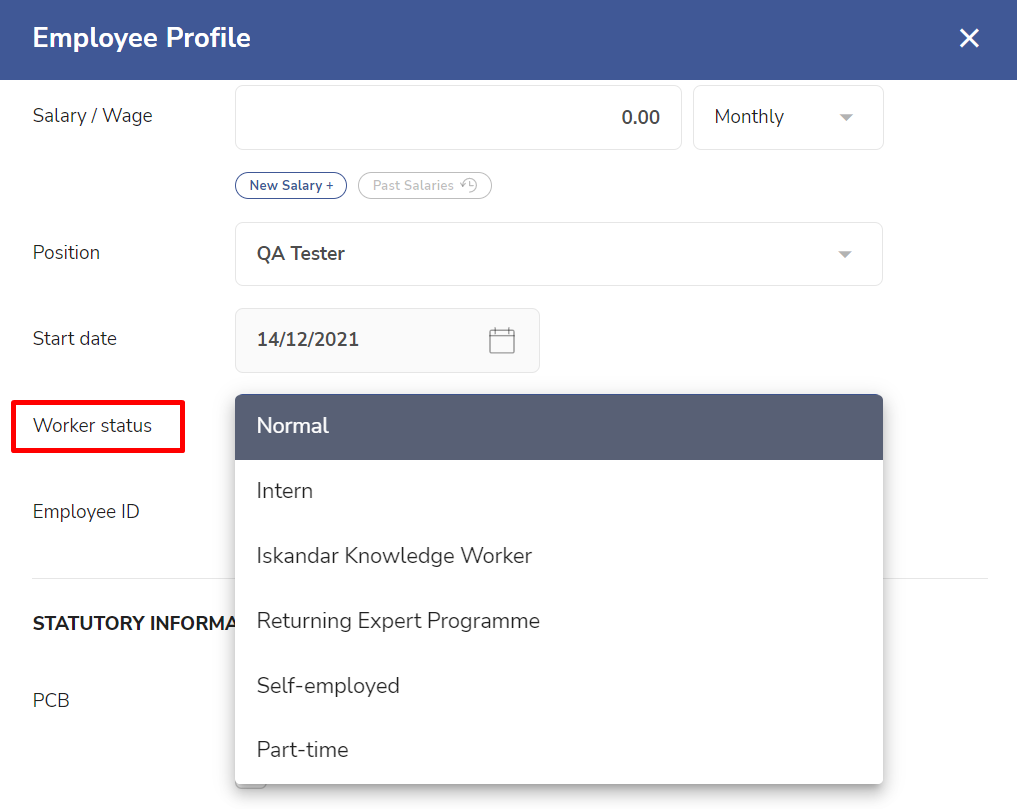

PayrollPanda will set the correct rates for statutory contributions based on the personal details entered in the employee’s profile. The statutory settings are also automatically updated the month after an employee turns 18 or 60. Please note that some statutory contributions may not apply when the Worker status is set to other than Normal. For more information, please refer to this article.

PCB

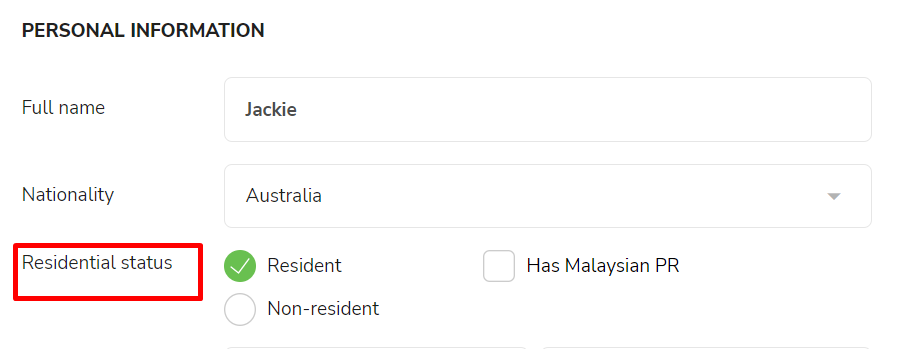

The rate of income tax will depend on the employee’s residence status, which is based on days of physical presence in Malaysia. You can set the employee’s Residential status in their profile.

- If the employee is a non-resident, they will be taxed at a flat rate of 30% and they will not be entitled to any of the tax deductions enjoyed by residents.

- If you are considered a resident, you will be taxed at a graduated rate of 0% to 30% depending on your income.

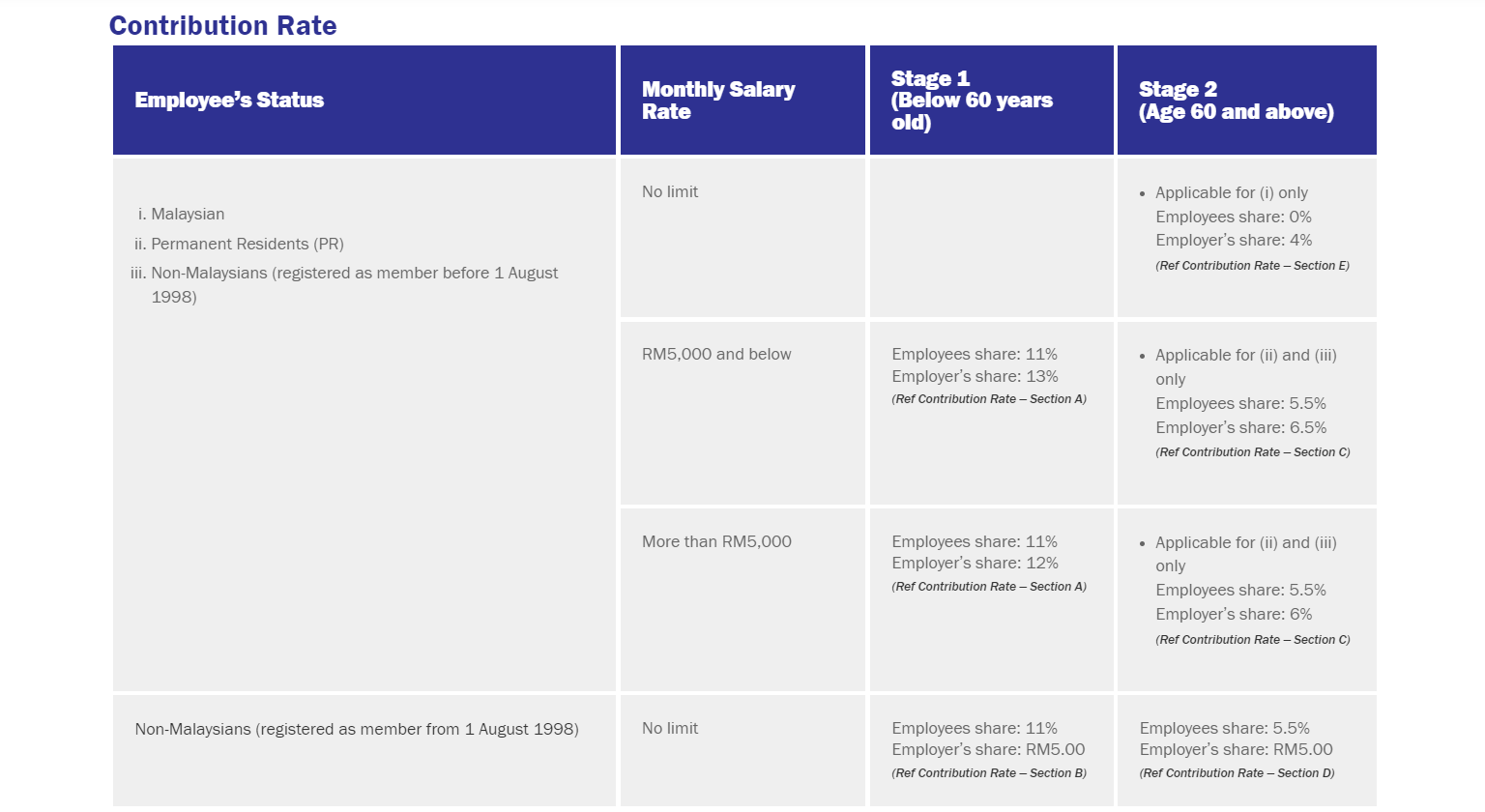

EPF

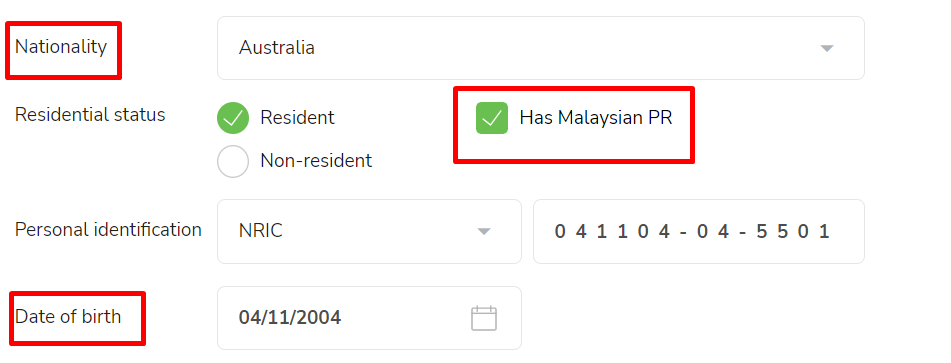

The employee’s date of birth and nationality (as well as permanent residence status for foreigners) determine the EPF employee and employer rates they will contribute at.

The actual contributions should be based on the contribution amounts for each salary range specified in the EPF Contribution Table. For salaries exceeding RM20,000, the exact percentage should be used, with any contributions including cents rounded up to the next ringgit.

SOCSO

The SOCSO category is determined based on the employee’s date of birth.

Employment Injury and Invalidity Scheme:

- Employees younger than 60 contribute under this category, unless they began contributing at the age of 55 or above.

- Under this category, the employer contributes at a rate of 1.75% of monthly wages up to a maximum value of RM 69.05, and the employee contributes at a rate of 0.5% up to a maximum value of RM 19.75.

Employment Injury Scheme:

- For employees aged 60 and above.

- For employees who began contributing to SOCSO at the age of 55 or above.

- For insured employees receiving an invalidity pension while still working, and receiving less than one third of their average monthly salary before invalidity.

- Under this category, the employer contributes at a rate of 1.25% of monthly wages, up to a maximum value of RM 49.40. There is no employee contribution.

SOCSO contribution amounts should be determined based on the Employees’ Social Security Act 1969 (Act 4) table.

EIS

The employee’s date of birth and nationality/permanent residence status determine whether an employee is subject to EIS.

All Malaysian and permanent resident employees aged between 18 and 60 must contribute under the Employment Insurance Scheme (EIS). Employees aged between 57 and 60 and who have never contributed to EIS are exempt. Foreign employees are not covered under EIS.

EIS employee and employer contributions are each set at 0.2% of monthly wages up to a maximum value of RM9.90. Contribution amounts should be determined based on the Employment Insurance System (Act 800) table.

HRDF

Only full-time Malaysian employees are included in the HRDF levy calculation. Therefore whether an employee is included for HRDF purposes will depend on the nationality set in their Profile tab and the Worker status in their Employment tab. Employees whose Worker status is set as Part-time will not have HRDF calculated.

Do ensure you have set the appropriate levy rate and registration category under Settings > Company Settings > Statutory Information > HRDF:

- Employers with 5 to 9 full-time Malaysian employees (whether permanent, contract or temporary) should register under the optional category and contribute at 0.5%.

- Employers with 10 or more full-time Malaysian employees (whether permanent, contract or temporary) should register under the compulsory category and contribute at 1%.

Please note that under HRDF regulations, if you registered under the optional category, once you reach 10 eligible employees, you must continue contributing at 1% for the whole calendar year even if your headcount falls to fewer than 10 employees later in the year. You can only reduce the levy rate to 0.5% again the following January if your headcount is still below 10 employees. Employers who registered under the compulsory category must continue contributing at 1% even if their headcount falls to below 10 employees. They must deregister in order to stop contributing.