In order to access e-PCB Plus or submit your CP22 or E forms, you will need to have an Employer or Employer Representative role. Here is a step-by-step guide on how you can apply for an employer role and/or appoint an employer representative in MyTax.

Applying for the Employer role

For Private Companies

One company director will need to apply for the role of Director in their MyTax account. The approval process takes up to 5 working days, and once completed, they will automatically be granted the Employer role. So, here’s a breakdown on how to do that:

- Head over to https://mytax.hasil.gov.my/ and log in to your account.

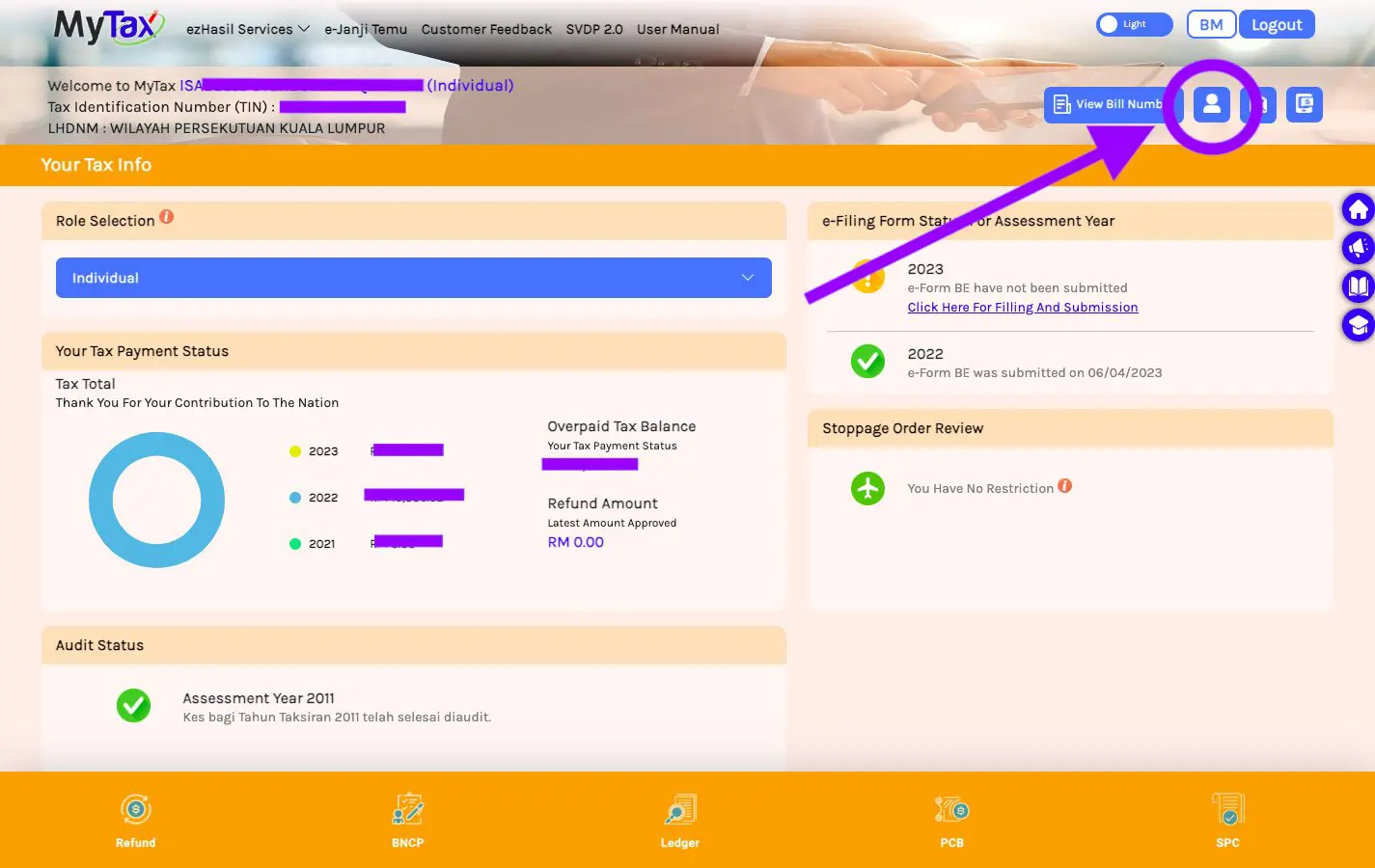

- Click on the profile icon at the top right.

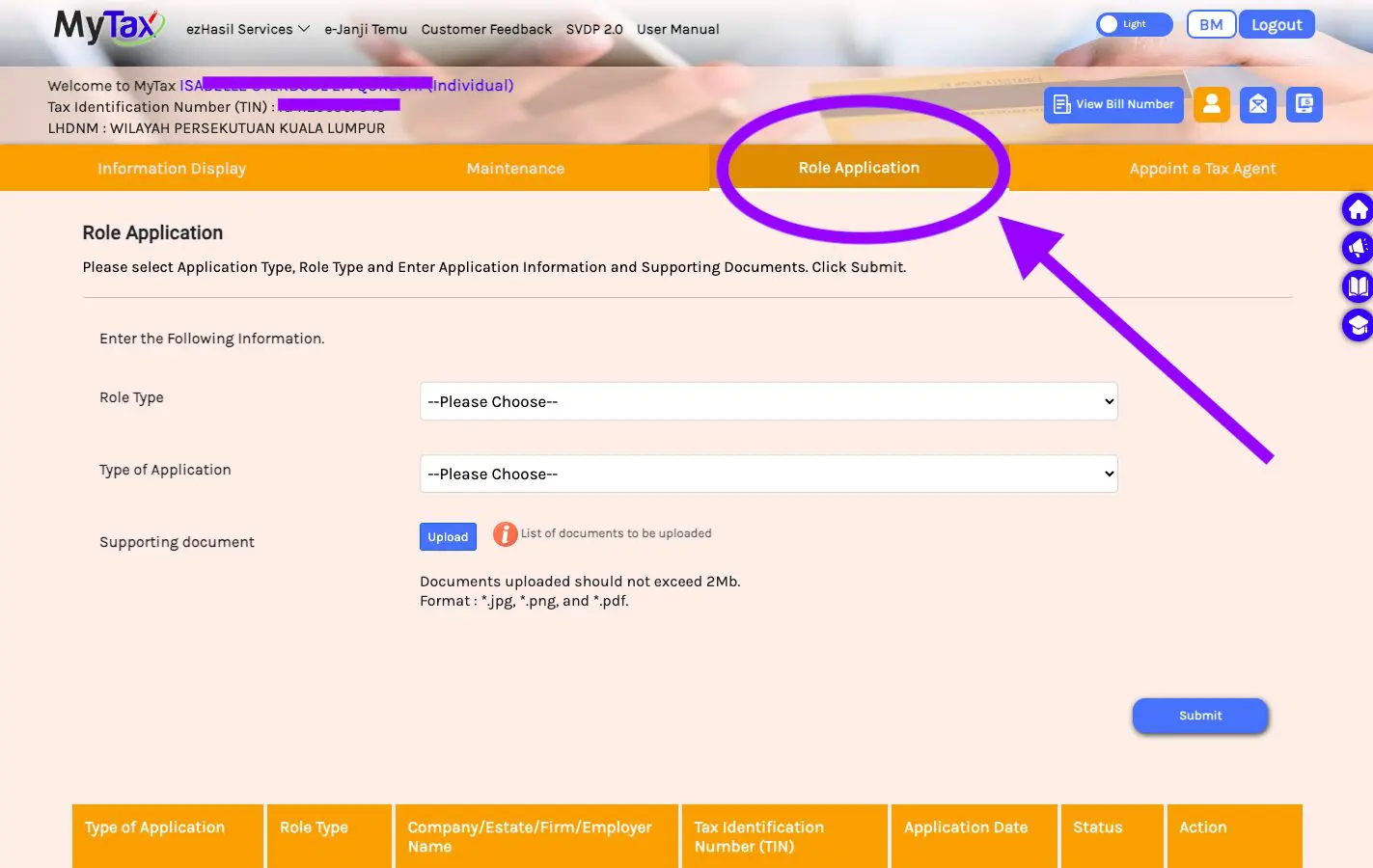

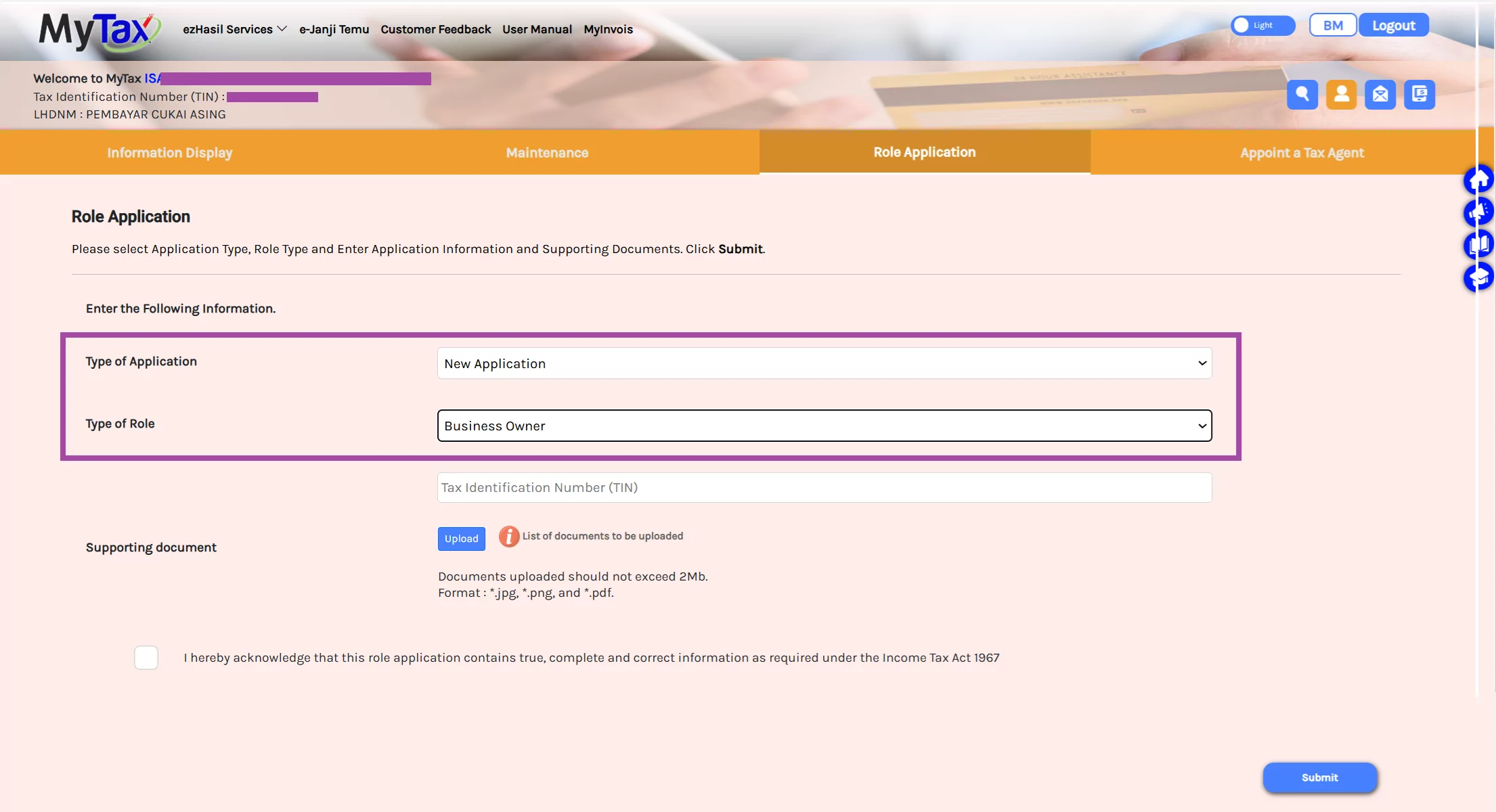

- Go to the third tab labelled ‘Role Application’.

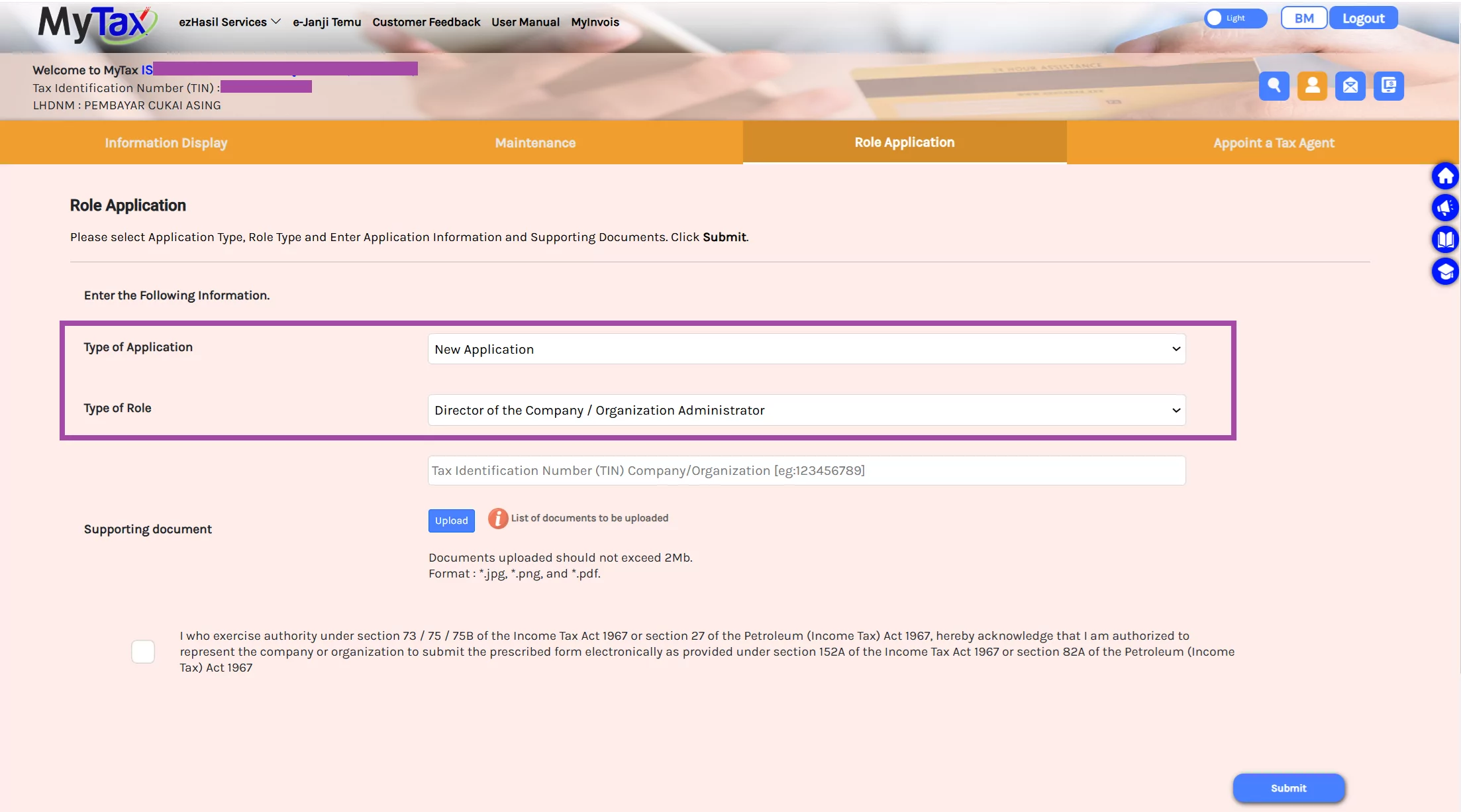

- Set ‘Type of Application’ as ‘New Application’.

- Set ‘Type of Role’ as ‘Director of the Company / Organization Administrator’.

- Enter your organisation’s TIN (Tax Identification Number).

- Upload the following documents as supporting documents: (i) Certificate of Registration (Form 9/Form Section 17) and (ii) List of directors (Form 49/Form Section 14).

- Click on the checkbox and press ‘Submit’.

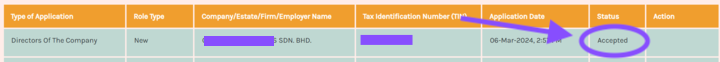

- Sit back, relax, and wait for the application to be processed – that will take up to 5 working days. The Status will change from ‘New’ to ‘Accepted’ once the application has been approved.

For Sole Proprietors and Partners

The process is the same as for company directors, except that sole proprietors/partners should select Business Owner as Type of Role. They will also be granted the Employer role automatically. The copy of business registration certificate (or copy of IC for sole proprietors without a business registration certificate) should be uploaded.

Appointing an Employer Representative

If you have an Employer role, you can appoint an Employer Representative in MyTax to assist you to submit employer forms via their MyTax account. Here’s how to do that:

- Before you start, please note that the Employer role is needed in order to assign the Employee Representative. If you need to apply for an Employer role, see the previous section for a step-by-step guide.

- Head over to https://mytax.hasil.gov.my/ and log in to your account.

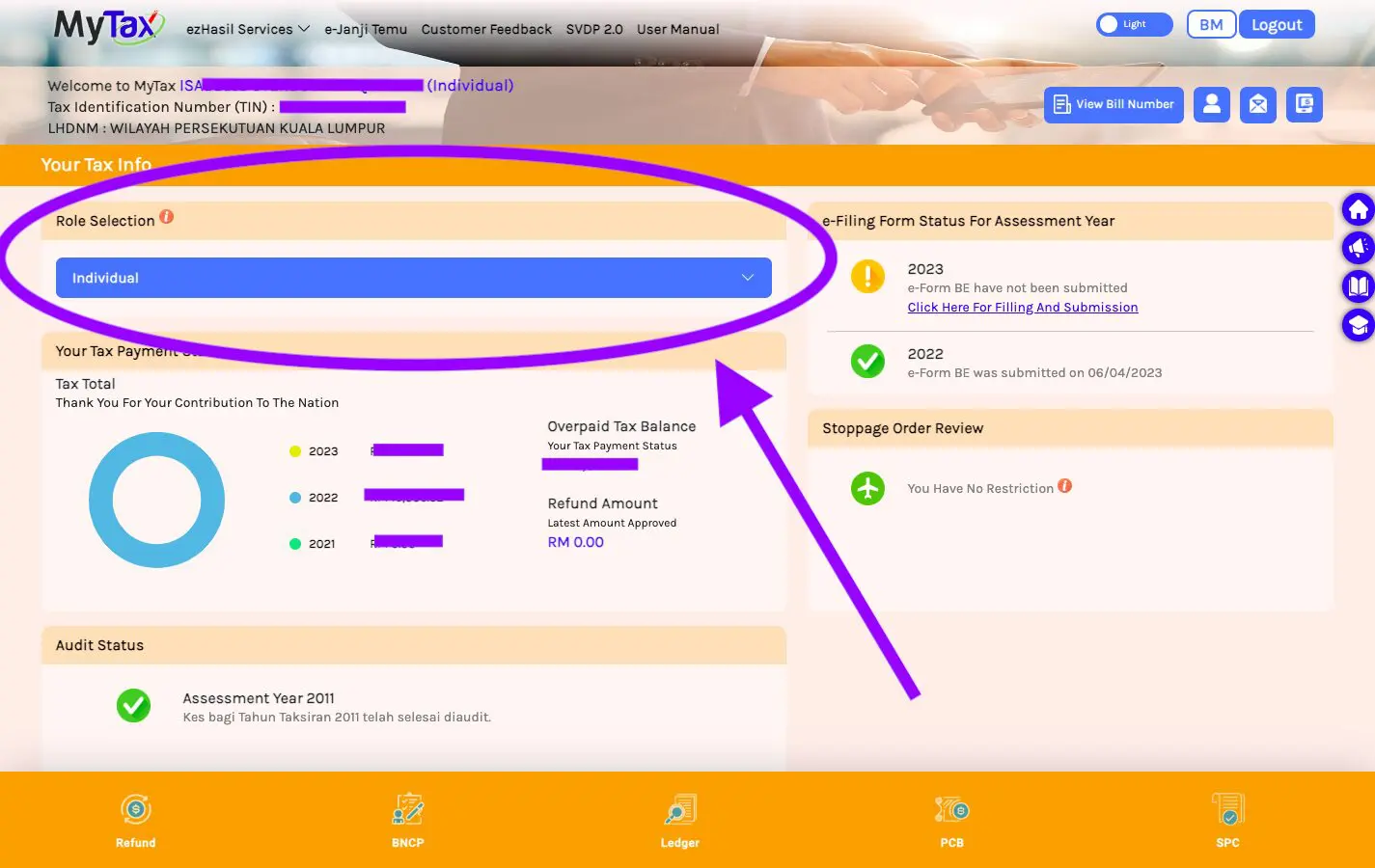

- Under ‘Role Selection’, click the blue tab.

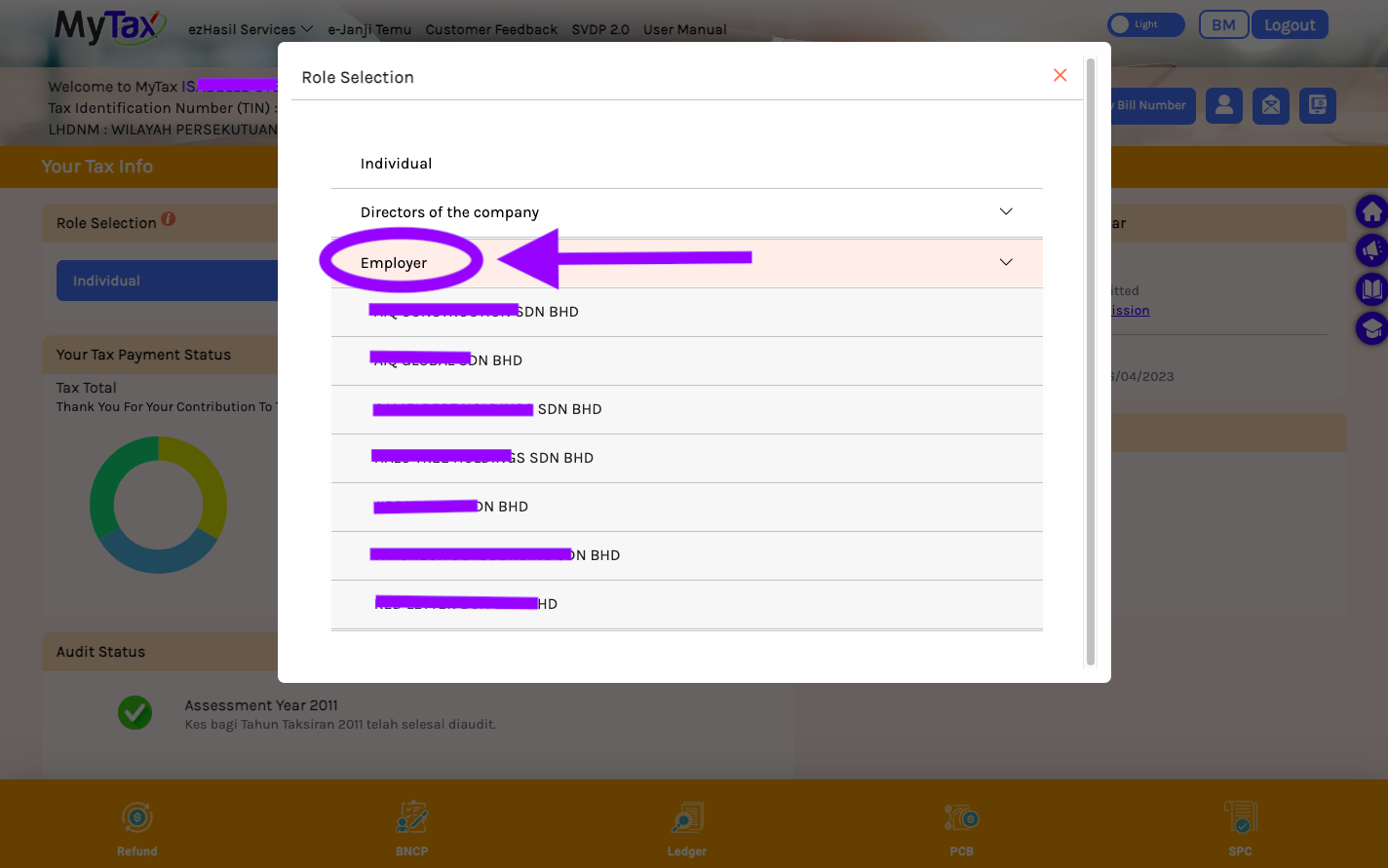

- Click ‘Employer’ and choose the entity for which you want to appoint an employer representative.

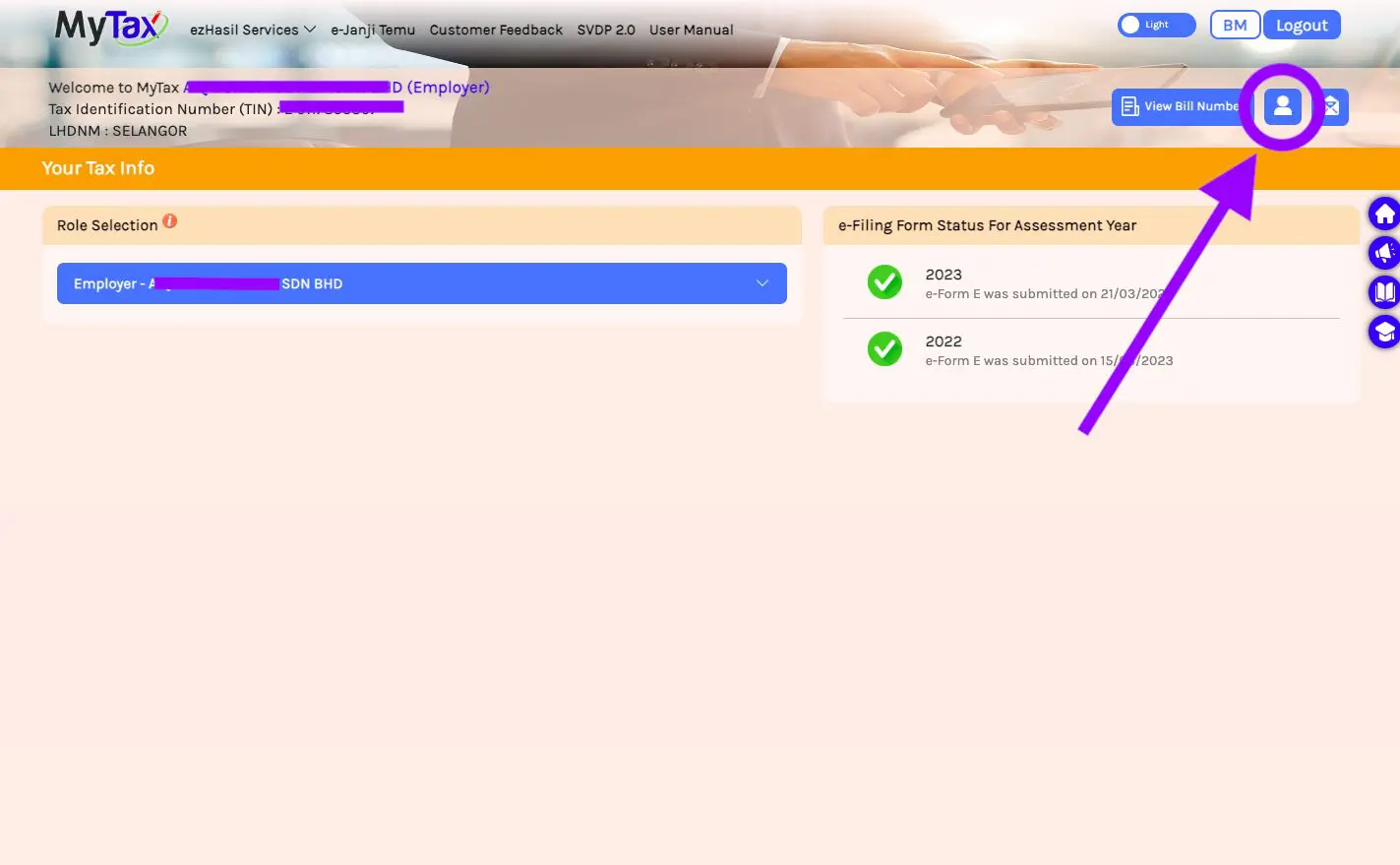

- Click on the profile icon.

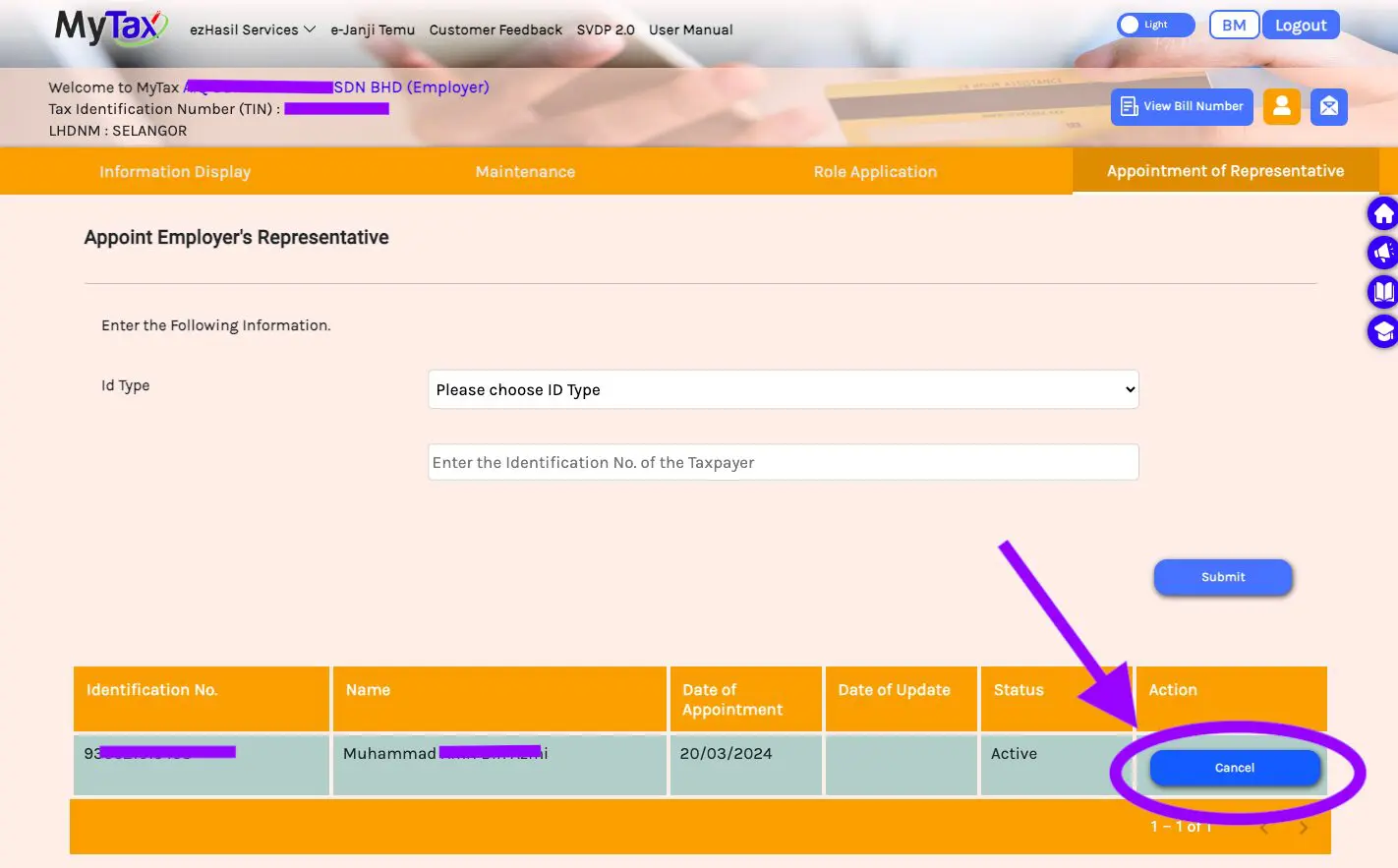

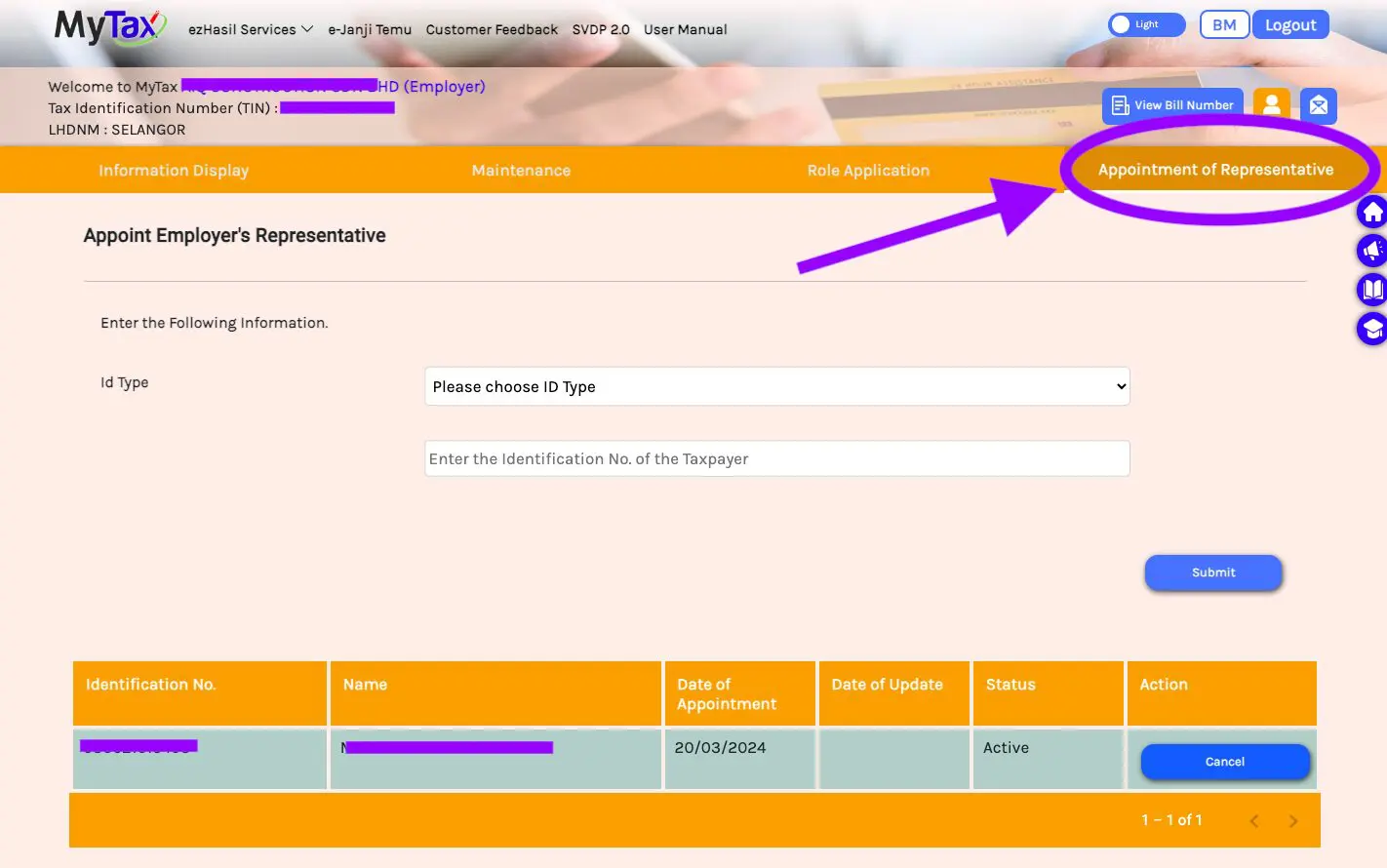

- Go to the fourth tab: ‘Appointment of Representative’.

- Choose the type of ID and insert the ID number of the person you want to appoint as an employer representative.

- Click ‘Submit’

- That’s it, all done!

The representative will appear in a table at the bottom of the page. Should you need to remove them as a representative, click the ‘Cancel’ button.